Monday, November 30, 2009

Sunday, November 29, 2009

Saturday, November 28, 2009

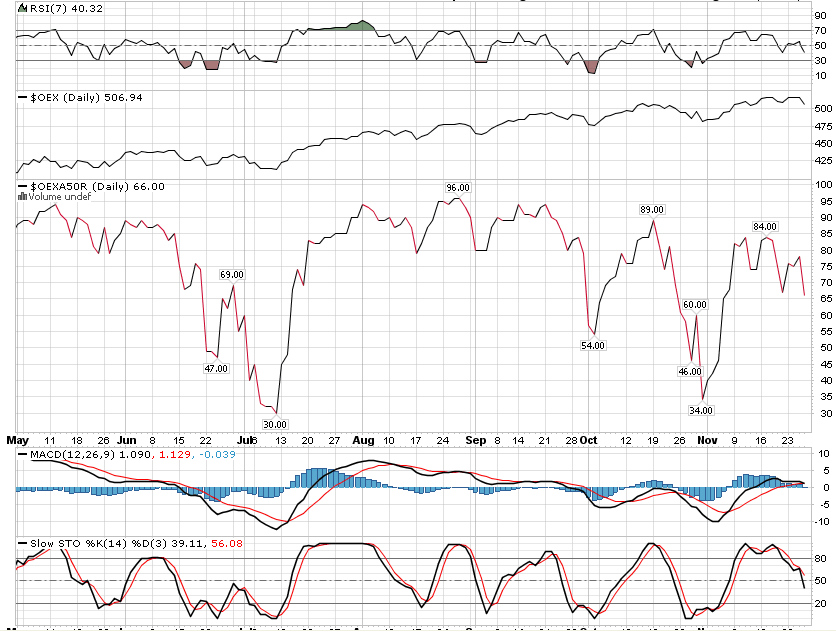

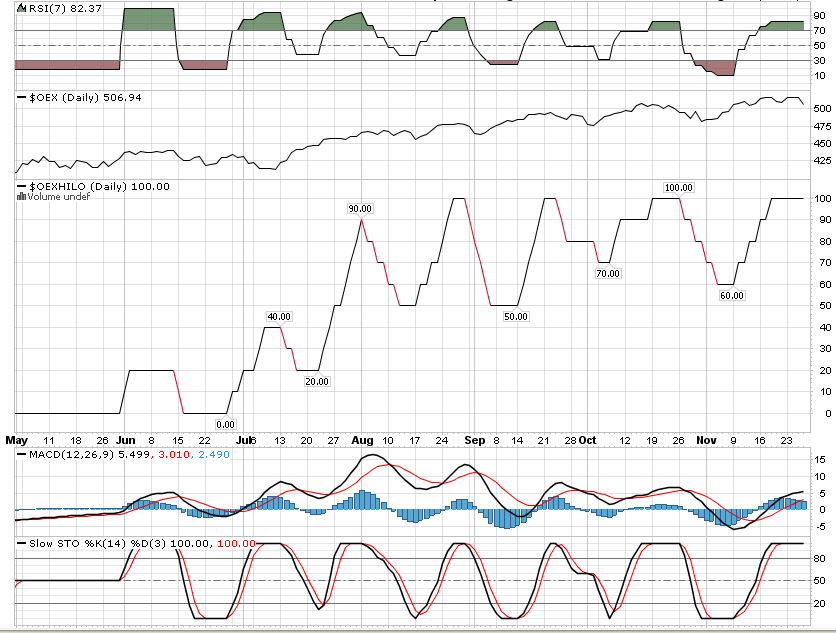

Market breath index correlated to market turning point

stock finder: extreme days correlated to market turning point?!

http://blogs.stockcharts.com/dont_ignore_this_chart/Market-Indicators/

The Record High Percent Index is the basis for another popular index called the Breadth Thrust Indicator. First developed by Martin Zweig, the Breadth Thrust Indicator is equal to the 10-day simple moving average of the Record High Percent Index.

According to Zweig, a "Breadth Thrust" occurs when the Breadth Thrust indicator rises from below 40% to above 61.5% within 10 trading days. The signal occurs when the given market is in the process of changing from an oversold condition to one of strength, but has not yet become overbought. Zweig goes on to say that this signal typically occurs before most bull markets.

"Breadth Thrusts" are rare but significant. When the market is really ready to rally again, expect to see the red line on this chart to jump.

Click on a symbol below to see how many (or what percent of) stocks are exceeding their moving averages:

Ticker Symbol

Ticker Ratio

Name

$DOWA150

$DOWA150R

DJ Industrials Stocks Above 150-Day Moving Average

$DOWA200

$DOWA200R

DJ Industrials Stocks Above 200-Day Moving Average

$DOWA50

$DOWA50R

DJ Industrials Stocks Above 50-Day Moving Average

$NAA150

$NAA150R

NASDAQ Stocks Above 150-Day Moving Average

$NAA200

$NAA200R

NASDAQ Stocks Above 200-Day Moving Average

$NAA50

$NAA50R

NASDAQ Stocks Above 50-Day Moving Average

$NDXA150

$NDXA150R

NASDAQ 100 Stocks Above 150-Day Moving Average

$NDXA200

$NDXA200R

NASDAQ 100 Stocks Above 200-Day Moving Average

$NDXA50

$NDXA50R

NASDAQ 100 Stocks Above 50-Day Moving Average

$NYA150

$NYA150R

NYSE Stocks Above 150-Day Moving Average

$NYA200

$NYA200R

NYSE Stocks Above 200-Day Moving Average

$NYA50

$NYA50R

NYSE Stocks Above 50-Day Moving Average

$OEXA150

$OEXA150R

S&P 100 Stocks Above 150-Day Moving Average

$OEXA200

$OEXA200R

S&P 100 Stocks Above 200-Day Moving Average

$OEXA50

$OEXA50R

S&P 100 Stocks Above 50-Day Moving Average

$SPXA150

$SPXA150R

S&P 500 Stocks Above 150-Day Moving Average

$SPXA200

$SPXA200R

S&P 500 Stocks Above 200-Day Moving Average

$SPXA50

$SPXA50R

S&P 500 Stocks Above 50-Day Moving Average

$TSXA150

$TSXA150R

S&P/TSX Composite Stocks Above 150-Day Moving Average

$TSXA200

$TSXA200R

S&P/TSX Composite Stocks Above 200-Day Moving Average

$TSXA50

$TSXA50R

S&P/TSX Composite Stocks Above 50-Day Moving Average

If you are very interested in using market indicators to improve your investment decisions, we recommend you visit DecisionPoint.com

PC Ratio vs IV http://www.market-harmonics.com/free-charts/sentiment/pcvi.htm

See below for description

Description

Much of the data used in tracking market sentiment is derived from the options market. On the one side is Put/Call data, which of course, is used to arrive at the daily Put/Call Ratio. More misunderstood is the volatility data that is used for arriving at values for the S&P 100-based VIX, and the Nasdaq 100-based VXN. Volatility in this context refers to Implied Volatility (IV), which is a factor in the pricing of options, particularly Put Options, which are used for portfolio protection, and as a way to profit from downturns in the market. The greater the amount of fear of financial loss, the more the “fear factor” is priced into the cost of Puts, and consequently, IV tends to go up. VIX readings of 50 or higher are associated with near-to-intermediate term market bottoms, and VXN readings of 70 or higher with the same.

One of the things that we've observed in our research, and which differentiates these data sets, is how rather significantly volatility data tends to lag Put/Call data. The most obvious reason is that a rise in the volume of Put purchases on a day the market is dropping tends to be a visceral reaction to real-time market conditions. In other words, there's a "herding psychology" involved that is more reactive than reasoned. On the other hand, options pricing is a thought out process, and an increase in IV is more trend-driven than event-driven. Market makers at the options exchanges price in volatility based on that of the underlying market. Therefore, if the market is basically bouncing back and forth within a certain price range, implied volatilities will also move within that same range. That data ends up being reflected in the daily VIX and VXN.

When a long-term period of selling sets in, such as we saw between March and October 2002, volatility indices start to gradually reflect the "fear factor" that then gets priced in to the purchase of Puts. When viewed in this context, we can see why bifurcations between P/C Ratios and the volatility data tend to occur.

Our Put/Call - VI chart plots the two sentiment data together to note when their trends diverge and converge. The left scale (in red) tracks the P/C Ratio, and the right scale (in blue) tracks the volatility data (based on the composite data we use to create our VIX-VXN Composite index). We set January 2001 as our base year, which is when the CBOE started publishing intraday data for the VXN.

One of the things you'll note immediately when viewing the chart is that the P/C data tends to reach tops and bottoms before the volatility data. Secondly, the volatility data often tends to overshoot the P/C data at peaks and troughs. One of the reasons for this is that trend changes aren't generally seen for what they are until well into the process. For instance, after a prolonged period of selling, people approach the market more cautiously, and that bearishness takes longer to work itself off in Put pricing. Of course, the reverse is also true, and it's one of the reasons why many contrarians believe that the VIX and VXN are a good measure of complacency in the markets.

The bottom line is that the P/C Ratio tends to be more of a "real-time" indicator, but doesn't provide enough of a benchmark for persistence of trend. At the same time, the VIX and VXN are too slow for timing purposes. When studying this chart, therefore, we want to look at divergences between the data sets, which are more apt to occur during periods of complacency, and at convergences, and in particular in-synch movement, to confirm the persistence of trend, and as an aid in marking sentiment extremes. These extremes, of course, are always followed by a reversal of the trend.

Friday, November 27, 2009

Margin Requirement on Leveraged ETF Products

Margin Requirement on Leveraged ETF Products (margin_change_20091201.1)

http://ibkb.interactivebrokers.com/node/1124

Overview:

Effective December 1, 2009, FINRA has implemented increased customer margin requirements for leveraged Exchange Traded Funds (ETFs) and uncovered options underlying leveraged ETFs (see NASD Rule 2520 and NYSE Rule 431).

Leveraged ETFs are a subset of ETFs which are intended to generate performance in multiples of that of the underlying index or benchmark (e.g. 200%, 300% or greater). In addition certain of these ETFs seek to a generate performance which is not only a multiple of but also the inverse of the underlying index or benchmark (e.g., a short ETF). These leveraged funds typically include among their holdings derivative instruments such as options, futures or swaps which are intended to provide the desired leverage and/or inverse performance.

The regulatory objective with respect to this margin increase is to recognize the leverage embedded in these instruments and establish a margin rate which is commensurate with that level of leverage (not to exceed 100% of the ETF value). Thus, for example, whereas the base strategy-based maintenance margin requirement for a non-leveraged long ETF will remain at 25% and a short non-leveraged ETF at 30%, examples of the maintenance margin change for leveraged ETFs are as follows:

1. Long an ETF having a 200% leverage factor: 50% (= 2 x 25%)

2. Short an ETF having a 300% leverage factor: 90% (= 3 x 30%)

A similar scaling in margin will also take effect for options. Thus, for example, whereas the base strategy-based maintenance margin requirement for a non-leveraged listed and uncovered broad based ETF index option will remain at 100% of the option premium plus 15% of the ETF market value less any out-of-the-money amount (to a minimum of 10% of ETF market value in the case of calls and 10% of the option strike price in the case of puts), that 15% rate will increase by the leverage factor of the ETF.

In the case of portfolio margin accounts, the effect will be similar, with the scan ranges by which the leveraged ETF positions will be stress tested increasing by the ETF leverage factor.

Clients maintaining positions in these ETFs should be aware that IB's standard liquidation policies will remain in effect upon the implementation of this new margin requirement and thereafter and any account which reports a margin deficit is subject to immediate liquidation.

A list of the leveraged ETF products impacted by this change are outlined below

SYMBOL

MULTIPLIER

DESCRIPTION

QLD

200%

PROSHARES ULTRA QQQ

QID

-200%

PROSHARES ULTRASHORT QQQ

SSO

200%

PROSHARES ULTRA S&P500

SH

-100%

PROSHARES SHORT S&P500

SDS

-200%

PROSHARES ULTRASHORT S&P500

PSQ

-100%

PROSHARES SHORT QQQ

MVV

200%

PROSHARES ULTRA MIDCAP400

MYY

-100%

PROSHARES SHORT MIDCAP 400

MZZ

-200%

PROSHARES ULTRASHORT MIDCAP400

DDM

200%

PROSHARES ULTRA DOW30

DOG

-100%

PROSHARES SHORT DOW30

DXD

-200%

PROSHARES ULTRASHORT DOW30

UWM

200%

PROSHARES ULTRA RUSSELL2000

RWM

-100%

PROSHARES SHORT RUSSELL2000

TWM

-200%

PROSHARES ULTRASHORT RUSSELL20

SAA

200%

PROSHARES ULTRA SMALLCAP600

SBB

-100%

PROSHARES SHORT SMALLCAP600

SDD

-200%

PROSHARES ULTRASHORT SMALLCAP6

UVG

200%

PROSHARES ULTRA RUSSELL1000 VA

SJF

-200%

PROSHARES ULTRASHORT RUSSELL10

UKF

200%

PROSHARES ULTRA RUSSELL1000 GR

SFK

-200%

PROSHARES ULTRASHORT RUSSELL10

UVU

200%

PROSHARES ULTRA RUSSELL MIDCAP

SJL

-200%

PROSHARES ULTRASHORT RUSSELL M

UKW

200%

PROSHARES ULTRA RUSSELL MIDCAP

SDK

-200%

PROSHARES ULTRASHORT RUSSELL M

UVT

200%

PROSHARES ULTRA RUSSELL2000 VA

SJH

-200%

PROSHARES ULTRASHORT RUSSELL20

UKK

200%

PROSHARES ULTRA RUSSELL2000 GR

SKK

-200%

PROSHARES ULTRASHORT RUSSELL20

UYM

200%

PROSHARES ULTRA BASIC MATERIAL

SMN

-200%

PROSHARES ULTRASHORT BASIC MAT

UGE

200%

PROSHARES ULTRA CONSUMER GOODS

SZK

-200%

PROSHARES ULTRASHORT CONSUMER

UCC

200%

PROSHARES ULTRA CONSUMER SERVI

SCC

-200%

PROSHARES ULTRASHORT CONSUMER

URE

200%

PROSHARES ULTRA REAL ESTATE

SRS

-200%

PROSHARES ULTRASHORT REAL ESTA

ROM

200%

PROSHARES ULTRA TECHNOLOGY

REW

-200%

PROSHARES ULTRASHORT TECHNOLOG

UPW

200%

PROSHARES ULTRA UTILITIES

SDP

-200%

PROSHARES ULTRASHORT UTILITIES

UYG

200%

PROSHARES ULTRA FINANCIALS

SKF

-200%

PROSHARES ULTRASHORT FINANCIAL

RXL

200%

PROSHARES ULTRA HEALTH CARE

RXD

-200%

PROSHARES ULTRASHORT HEALTHCAR

UXI

200%

PROSHARES ULTRA INDUSTRIALS

SIJ

-200%

PROSHARES ULTRASHORT INDUSTRIA

DIG

200%

PROSHARES ULTRA OIL & GAS

DUG

-200%

PROSHARES ULTRASHORT OIL & GAS

USD

200%

PROSHARES ULTRA SEMICONDUCTORS

SSG

-200%

PROSHARES ULTRASHORT SEMICONDU

EFZ

-100%

PROSHARES SHORT MSCI EAFE

EFU

-200%

PROSHARES ULTRASHORT MSCI EAFE

FXP

-200%

PROSHARES ULTRASHORT FTSE/XINH

DXSP

-100%

DB X-TRACKERS DJ ES 50 SHORT

EUM

-100%

PROSHARES SHORT MSCI EMERGING

EEV

-200%

PROSHARES ULTRASHORT MSCI EMER

EWV

-200%

PROSHARES ULTRASHORT MSCI JAPA

RMM

200%

RYDEX 2X S&P MIDCAP 400 ETFLCAP

RMS

-200%

RYDEX INVERSE 2X S&P MIDCAP

RSU

200%

RYDEX 2X S&P 500 ETF

RSW

-200%

RYDEX INVERSE 2X S&P 500 ETF

RRY

200%

RYDEX 2X RUSSELL 2000 ETFALLCAP

RRZ

-200%

RYDEX INVERSE 2X RUSS 2000

LTL

200%

PROSHARES ULTRA TELECOMMUNICAT

TLL

-200%

PROSHARES ULTRASHORT TELECOMMU

PST

-200%

PROSHARES ULTRASHORT LEHMAN 7-

TBT

-200%

PROSHARES ULTRASHORT LEHMAN 20

SEF

-100%

PROSHARES SHORT FINANCIALS

BGU

300%

LARGE CAP BULL 3X SHARES

BGZ

-300%

LARGE CAP BEAR 3X SHARES

TNA

300%

SMALL CAP BULL 3X SHARES

TZA

-300%

SMALL CAP BEAR 3X SHARES

RHM

200%

RYDEX 2X HEALTH CARE

RHO

-200%

RYDEX INV 2X HEALTH CARE

RFL

200%

RYDEX 2X FINANCIAL

RFN

-200%

RYDEX INV 2X FINANCIAL

RTG

200%

RYDEX 2X TECHNOLOGY

RTW

-200%

RYDEX INV 2X TECHNOLOGY

REC

-200%

RYDEX INV 2X S&P ENERGY

REA

200%

RYDEX 2X ENERGY

DDG

-100%

PROSHARES SHORT OIL & GAS

ERX

300%

ENERGY BULL 3X SHARES

UMM

300%

MACROSHARES MAJ MET HOU UP

ERY

-300%

ENERGY BEAR 3X SHARES

TBF

-100%

PROSHARES SHORT 20+ TREASURY

DXSN

-100%

DB X-TRACKERS SHORTDAX ETF

RTR

250%

REVENUESHARES ADR FUND

X4S

-100%

DBXT CAC 40 SHORT

EUO

-200%

PROSHARES ULTRASHORT EURO

ULE

200%

PROSHARES ULTRA EURO

ULE

200%

PROSHARES ULTRA EURO

EUO

-200%

PROSHARES ULTRASHORT EURO

YCL

200%

PROSHARES ULTRA YEN

YCS

-200%

PROSHARES ULTRASHORT YEN

XUKS

-100%

DB X-TRACKERS FTSE 100 SHORT ETF

XUKS

-100%

DB X-TRACKERS FTSE 100 SHORT ETF

XSPS

-100%

DB X-TRACKERS S&P 500 SHORT

DXSR

-100%

DB X-TR II TRX EUR 5Y SH TR

XSPS

-100%

DB X-TRACKERS S&P 500 SHORT

DXSR

-100%

DB X-TR II TRX EUR 5Y SH TR

XSPD

-100%

DB X-TRACKERS S&P 500 SHORT

DXST

-100%

DB X-TR II TRX CRS 5Y SH TR

UGL

200%

PROSHARES ULTRA GOLD

GLL

-200%

PROSHARES ULTRASHORT GOLD

AGQ

200%

PROSHARES ULTRA SILVER

ZSL

-200%

PROSHARES ULTRASHORT SILVER

DZK

300%

DIREXION DEVELOP MKT BULL 3X

DPK

-300%

DIREXION DEVELOP MKT BEAR 3X

EDC

300%

DIREXION EMERG MKT BULL 3X

EDZ

-300%

DIREXION EMERG MKT BEAR 3X

TYH

300%

DIREXION TECHNOLOGY BULL 3X

TYP

-300%

DIREXION TECHNOLOGY BEAR 3X

MWJ

300%

DIREXION MID CAP BULL 3X

FAS

300%

DIREXION DAILY FIN BULL 3X

SCO

-200%

PROSHRE U/S DJ-AIG CRUDE OIL

UCO

200%

PROSHRE ULT DJ-AIG CRUDE OIL

UCD

200%

PROSHRE ULT DJ-AIG COMMODITY

CMD

-200%

PROSHRE U/S DJ-AIG COMMODITY

DES2

-200%

ETFX DAX 2X SHORT FUND

DTO

-200%

POWERSHARES DB OIL 2X SHORT

DGP

200%

DB GOLD DOUBLE LONG ETN

DZZ

-200%

DB GOLD DOUBLE SHORT ETN

BDD

200%

POWERSHARES DB METALS 2X

BOS

-100%

POWERSHARES DB METALS SHORT

BOM

-200%

POWERSHARES DB MTLS 2X SHORT

SZO

-100%

POWERSHARES DB CRUDE SHORT

DEE

-200%

DB COMMODITY DOUBLE SHORT

DDP

-100%

PWRSHS DB COMMODITY SHORT

DYY

200%

DB COMMODITY DOUBLE LONG ETN

DAG

200%

DB AGRICULTURE DOUBLE LONG

AGA

-200%

DB AGRI DOUBLE SHORT ETN

ADZ

-100%

DB AGRICULTURE SHORT ETN

DGZ

-100%

DB GOLD SHORT ETN

PTM

-100%

E-TRACS UBS LONG PLATIN ETN

PTD

-100%

E-TRACS UBS SHORT PLATIN ETN

SHC

-100%

LYXOR SHORT CAC 40

SHA

-100%

LYXOR ETF SHORT AEX

DGU

200%

DB GOLD DOUBLE LONG ETN

DGJ

-200%

DB GOLD DOUBLE SHORT ETN

DAA

200%

DB AGRICULTURE DOUBLE LONG

DAD

-200%

DB AGRI DOUBLE SHORT ETN

DOE

-200%

POWERSHARES DB OIL 2X SHORT

SAGR

-100%

ETFS SHORT AGRICUL DJ-AIGCI

SALU

-100%

ETFS SHORT ALUMINIUM

SCOC

-100%

ETFS SHORT COCOA

SWEA

-100%

ETFS SHORT WHEAT

SCFE

-100%

ETFS SHORT COFFEE

SCTO

-100%

ETFS SHORT COTTON

SSYO

-100%

ETFS SHORT SOYBEAN OIL

SCOR

-100%

ETFS SHORT CORN

SGAS

-100%

ETFS SHORT GASOLINE

SCOP

-100%

ETFS SHORT COPPER

SBUL

-100%

ETFS SHORT GOLD

SLHO

-100%

ETFS SHORT LEAN HOGS

SLCT

-100%

ETFS SHORT LIVE CATTLE

SOIL

-100%

ETFS SHORT CRUDE OIL

SHEA

-100%

ETFS SHORT HEATING OIL

SNIK

-100%

ETFS SHORT NICKEL

SSOB

-100%

ETFS SHORT SOYBEANS

SSIL

-100%

ETFS SHORT SILVER

SNGA

-100%

ETFS SHORT NATURAL GAS

SPLA

-100%

ETFS SHORT PLATINUM

SLEA

-100%

ETFS SHORT LEAD

STIM

-100%

ETFS SHORT TIN

SSUG

-100%

ETFS SHORT SUGAR

SHE

-100%

LYXOR SHORT EUROPE

DXS8

-100%

DB X-TRACKERS DJ STOXX 600 B

DXS9

-100%

DB X-TRACKERS DJ STOXX 600 H

DX2A

-100%

DB X-TRACKERS DJ STOXX 600 O

DX2B

-100%

DB X-TRACKERS DJ STOXX 600 T

DX2C

-100%

DB X-TRACKERS 600 TELECOM SH

DX2K

-100%

DB X-TRACKERS FTSE 100 SHORT ETF

9GA7

-100%

ETFS SHORT CRUDE OIL

TYD

300%

DIREXION DLY 10-Y TR BULL 3X

TMF

300%

DIREXION DLY 30-Y TR BULL 3X

TYO

-300%

DIREXION DLY 10-Y TR BEAR 3X

TMV

-300%

DIREXION DLY 30-Y TR BEAR 3X

4RTQ

-100%

ETFS SHORT COCOA

9GA3

-100%

ETFS SHORT COFFEE

9GA5

-100%

ETFS SHORT CORN

9GA6

-100%

ETFS SHORT COTTON

4RTG

-100%

ETFS SHORT SOYBEAN OIL

4RTH

-100%

ETFS SHORT SOYBEANS

4RTK

-100%

ETFS SHORT WHEAT

4RTJ

-100%

ETFS SHORT SUGAR

9GAZ

-100%

ETFS SHORT PETROLEUM DJ-AIGC

EFO

200%

PROSHARES ULTRA MSCI EAFE

EET

200%

PROSHARES ULT MSCI EMER MKTS

XPP

200%

PROSHARES ULT FTSE/XIN CH 25

EZJ

200%

PROSHARES ULTRA MSCI JAPAN

4RTD

-100%

ETFS SHORT NATURAL GAS

BZQ

-200%

PROSHARES ULTRASHORT MSCI BR

EPV

-200%

PROSHARES ULTRASHORT MSCI EU

SMK

-200%

PROSHARES ULTRASHORT MSCI ME

JPX

-200%

PROSHARES ULTRASHORT MSCI PA

MWN

-300%

DIREXION DLY MID CAP BEAR 3X

UPRO

300%

PROSHARES ULTRAPRO S&P 500

SPXU

-300%

PROSH ULTRAPRO SHORT S&P 500

UWC

200%

PROSHARES ULTRA RUSSELL 3000

TWQ

-200%

PROSHARES ULTRASHORT RUSSELL

FAZ

-300%

DIREXION DAILY FINL BEAR 3X

DRV

-300%

DIREXION DAILY REAL EST BEAR

DRN

300%

DIREXION DAILY REAL EST-BULL

DMM

-300%

MACROSHARES MAJ MET HOU DOWN

SALL

-100%

ETFS SHORT ALL COMM DJ-AIGCI

SNRG

-100%

ETFS SHORT ENERGY DJ-AIGCI

SNEY

-100%

ETFS SHORT EX-ENERGY DJ-AIGC

SGRA

-100%

ETFS SHORT GRAINS DJ-AIGCI

SIMT

-100%

ETFS SHORT INDUSTRIAL METALS

SLST

-100%

ETFS SHORT LIVESTOCK DJ-AIGC

SPET

-100%

ETFS SHORT PETROLEUM DJ-AIGC

SPMT

-100%

ETFS SHORT PRECIOUS MTLS

SSFT

-100%

ETFS SHORT SOFTS DJ-AIGCI

SZIC

-100%

ETFS SHORT ZINC

DEL2

200%

ETFX DAX 2X LONG FUND

DL2P

200%

ETFX DAX 2X LONG FUND

SEU2

-200%

ETFX DJ EURO ST 50 DBL SH 2X

SE2P

-200%

ETFX DJ EURO ST 50 DBL SH 2X

LEU2

200%

ETFX DJ EURO STOXX 50 LEV 2X

DS2P

-200%

ETFX DAX 2X SHORT FUND

LE2P

200%

ETFX DJ EURO STOXX 50 LEV 2X

LUK2

200%

ETFX FTSE 100 LEVERAGED 2X

SUK2

-200%

ETFX FTSE 100 SUP SHRT ST 2X

DES2

-200%

ETFX DAX 2X SHORT FUND

XC4S

-100%

DBXT CAC 40 SHORT

XSKS

-100%

DB X-TRACKERS 600 TELECOM SH

XSPS

-100%

DB X-TRACKERS S&P 500 SHORT

XSDX

-100%

DB X-TRACKERS SHORTDAX ETF

XS8S

-100%

DB X-TRACKERS DJ STOXX 600 T

XSSX

-100%

DB X-TRACKERS DJ ES 50 SHORT

XS7S

-100%

DB X-TRACKERS DJ STOXX 600 B

XSDS

-100%

DB X-TRACKERS DJ STOXX 600 H

XSES

-100%

DB X-TRACKERS DJ STOXX 600 O

DEL2

200%

ETFX DAX 2X LONG FUND

DNO

-100%

UNITED STATES SHORT OIL FUND

EZC

-200%

EASYETF CAC40 DOUBLE SHORT

Links:

Finra Regulatory Notice 09-53 (ETF Margin Increase)

- CredMan

- LiqMonitor

- Margin

- Option Strategies

- Portfolio Margin

- Reg T Margin

- Regulatory Agencies

- Stocks/ETFs