http://www.esignal.com/esignal/pricing.aspx

History Newly Enhanced!

eSignal is constantly adding historical data to the individual exchanges / services it offers through its datafeed; the number of years listed for any exchange grouping is an average of the individual exchanges within that category.

| Category | Tick | Standard Intraday* | Extended Intraday ** | Daily |

| North American Stocks | 10 days | 120 days | Back to Apr 1997 | Back to 1990 |

| North American Futures | 10 days | 120 days | Back to Mar 2007 | Varies by contract, as many as 9 years *** |

| North American Options | -- | -- | -- | Up to 1 year |

| North American Indices | 10 days | 120 days | Back to Apr 1997 | Back to 1990 (as far as 1970 for several) |

| Mutual Funds / Money Markets | -- | -- | -- | Back to 1994 |

| European Equities and Indices | 10 days | 120 days | -- | 5 - 10+ years (varies by instrument) |

| Asia Pacific Equities and Indices | 10 days | 60 days | -- | 2 - 5+ years (varies by instrument) |

| European / Asia Pacific Futures | 10 days | 120 days | Back to Mar 2007 | Varies by contract, as many as 9 years *** |

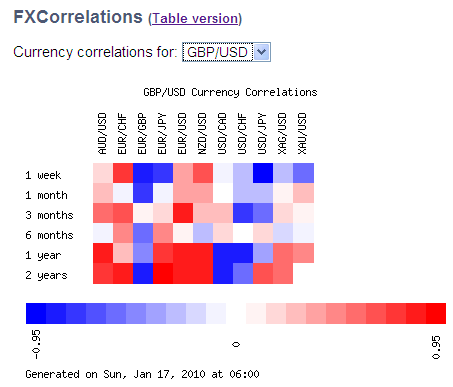

| Forex (bid / ask data only) | 10 days | 120 days | Back to Mar 2007 | Back to 1983 on major pairs |

| GovPx Treasuries | 10 days | 120 days | Back to Mar 2007 | Back to 2006 |

* 120 days of standard intraday history available in eSignal's Advanced Charting and in most third party applications (such as Metastock or Ensign). eSignal's standard charting will continue to go back 60 days.

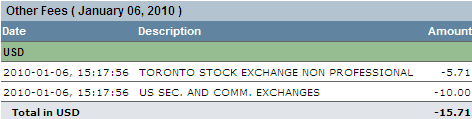

** Extended intraday data is available to eSignal users as an add-on service. Please note that extended intraday data is not available to eSignal API products (including third party applications). A $10 fee is associated with this level of data.

*** Please note that data on some contracts now goes back as far as 1973. History available varies by contract type.