Thursday, March 24, 2011

Wednesday, March 23, 2011

Evidence showing many retail investors play on the same gap pivot point

128.56 at 9:45am. 1 hold gap pivot is 128.57. Penetrated by 1 cent. Then reversal. But false reversal followed by plunging.

Monday, March 21, 2011

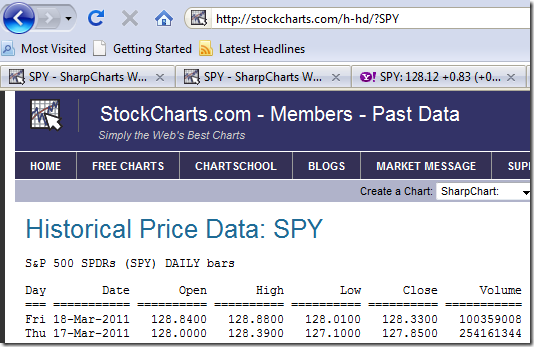

Friday, March 18, 2011

Thursday, March 17, 2011

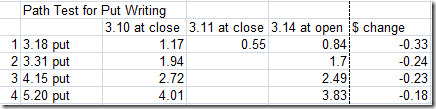

Options Time Decay Paths Test

http://www.optiontradingpedia.com/free_option_greeks.htm

Characteristics Of Theta Value

You might have noticed something perculiar about the theta of Out of The Money (OTM) options when comparing the two pictures above and that is, theta value for OTM options are higher with longer expiration and lower with nearer expiration.Indeed, theta behaves differently for ITM/ATM options and OTM options:

ITM/ATM Options Theta

Further Expiration : Low ThetaNearer EXpiration : High Theta

OTM Options Theta

Further Expiration : High ThetaNearer EXpiration : Low Theta

As you can see from the below illustrations, ITM and ATM options decays fastest during the last 30 days to expiration whereas OTM options decays the least during the final 30 days, which is also due to the fact that OTM options near to expiration has too little premium value left to decay on anyways.

Tuesday, March 15, 2011

Tuesday, March 08, 2011

DT Proxy using delta neutral calendar spread

not perfect, has theta effect, but close enough with 1-2 days. SPY moves should be bigger than $0.20, after delta, $0.09 move, after commission, $0.04, after spread and hedge system error, $0.00.

Use ATM options as proxy for day trade

2:30-3:30pm, asset 132.37 to 132.82, most heavily traded front month Mar 18, 2011 ATM call 132, 1.67 to 1.93, delta about 26/45=0.58

Monday, March 07, 2011

$131 put for income maybe paid out

13:47, Friday, sold Mar 11 131 PUT, 0.94

AT that time, Mar 137 put was 5.82.

Today when closing the position, 0.94 –>1.11 , 5.82 –> 6.37, net $0.38 compared to previous day.

Thursday, March 03, 2011

Free options courses on OIC website

http://education.optionseducation.org/oic_courses/OIC401C/pastfuture_09.html

http://www.optioneducation.net/calculator/pu_volatility.asp

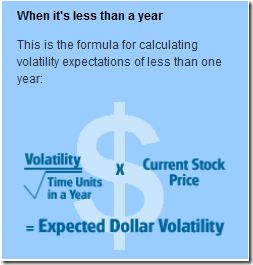

Assessing values, choosing strategies

If implied volatility levels are lower than usual — that is, the options appear relatively undervalued — these investors might choose strategies that involve long options positions. For instance, if they're bullish on an underlying stock, they may buy calls. On the other hand, if volatility levels seem to be high at the time, and the options seem overvalued, they might choose strategies that use short options. If they're still bullish on the stock, they may choose to sell cash-secured puts or covered calls.