80% range, 20% trending.

Thursday, October 27, 2011

Wednesday, October 26, 2011

Learning: Taking Advantage of the Markets with Quant Research (Part of The Agora Financial Educational Series)

3 things to be successful: Trend persistence, range, liquidity.

Most trend persistence instrument ETF: UTH, utility holder.

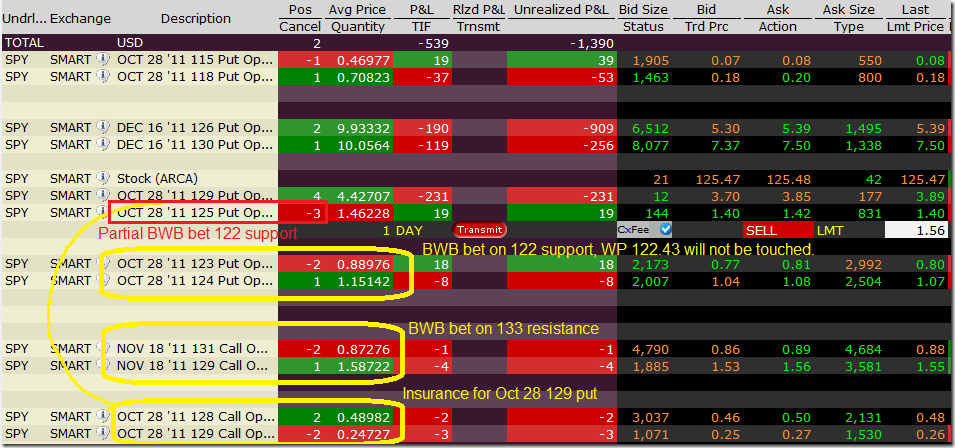

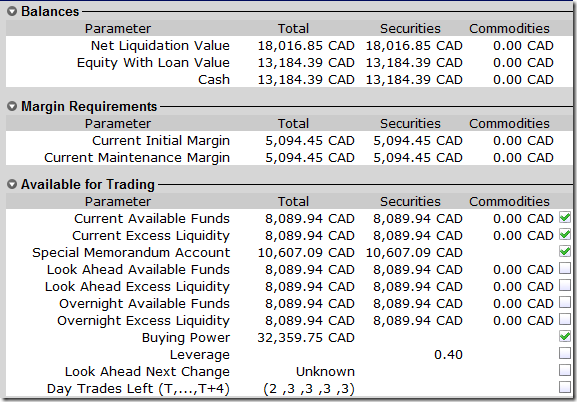

Full Hedged and waiting for time decay.

Best outcome is when SPY is 123 at expiration.

Watchout: Flatten the position might take some steps and strategy.

Two Options Strategies for Every Investor (Part of The Agora Financial Educational Series)

Sell covered deep in the money call

LEAP: If you are not nerve investor (longer than 3 years horizon), buy LEAP rather than stocks.

Small move in price can change a lot of LEAP price.

Learning: Price Headley Using Option Charts

1. 80/20 rule. 80% profit from 20% of trades

2. Every strategy has hot and cold streak. Use MA(Equity curve from last 10 trades) as guide. If below it, don’t trade, but still track/paper trade it until equity curve crosses above MA(last 10 equity) .

3. Option chart is slower than underlying. But rather missing out than being trapped in due to entry too early. Use EMA(10D)

4. Check the inverse chart. Maybe have less noisy trend (clearer signal).

5. Intraday chart, don’t go less than 30 min, because noise goes up exponentially.

6. $VIX chart, everyone follows. See it from far away place. such as weekly chart. Close lower than previous L after up trend. $VIX trending lower, SPY trending higher.

Monday, October 24, 2011

Sum of Delta: –2.75 to make trade decision; 18K intraday

| Call | 115 | 2 | 0.9672 | 1.9344 | |

| 117 | 2 | 0.9297 | 1.8594 | ||

| 121 | -6 | 0.6733 | -4.0398 | ||

| -0.246 | |||||

| Put | Dec 130 | 1 | -0.7376 | -0.7376 | |

| Dec 126 | 2 | -0.6063 | -1.2126 | ||

| Nov 128 | 1 | -0.7239 | -0.7239 | ||

| Oct 123 | 1 | -0.5654 | -0.5654 | ||

| Oct 121 | -1 | -0.3267 | 0.3267 | ||

| Oct 120 | -1 | -0.2293 | 0.2293 | ||

| Oct 116 | -3 | -0.0493 | 0.1479 | ||

| Oct 115 | -1 | -0.0328 | 0.0328 | ||

| -2.5028 | |||||

| -2.7488 |

Covered 1 Oct 121 call short because aggregated delta is –2.75. Why just one? It’s because DP is not tested. And because SPY maybe bounce back in this narrow range day (yesterday and the day before were big swing).

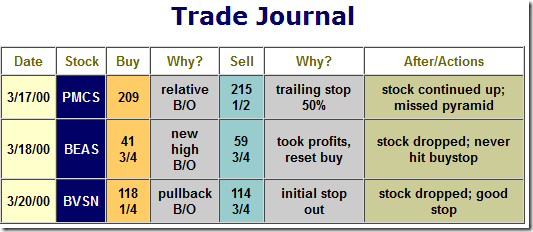

Friday, October 14, 2011

Extraordinary $110 profit at the last 40 minutes

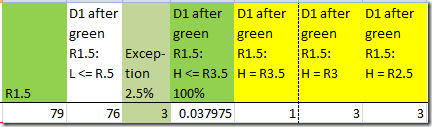

If D-1 is a green DR1.5 day, then next day High (red resistance) should exceed DR0.5 at least. Traded with statistics in mind, but didn’t go expected. Did I create this Black Swan? Anyway, I bet 5 lot much bigger then usual. $110 profit.

Sacrificed 1 DT quota.

Thursday, October 06, 2011

Oct 7 trading plan

Plan A: At the market open, close all call positions, except 1 short Oct 7 117 call and bet it will expire worthless. At least much lower than 0.65.

Plan B

Exit sell Oct 14 107 call and cover 108 call. Used for hedge exit to save DT quota.

Exit sell Oct 14 107 call and cover Oct 7 105 call. Price not likely to deep below 105.

This will leave 1 long Oct 14 107 call, 2 short Oct 7 116 call and 1 short Oct 7 117 call.

Then, cover 1 Oct 7 116 call.