2 clue lines: opening price and not yet worked IVB/OVB

Friday, June 22, 2012

Wednesday, June 20, 2012

The Market Maker’s Edge

- Ameritrade’s ad pitching online day traders. “I don’t want to just beat the market. I want to wrestle its scrawny little body to the ground and make it beg for mercy.”This is faulty, ego-based, unrealistic thinking that will lead toward losses, not profits. The market is never wrong and it cannot be defeated. It is selfless. It does not experience feelings of victory or defeat. The market is a cold battlefield and its participants are engaged in a life-or-death battle against themselves.

- Even when traders have developed a clear-cut definition of a trend, they often disregard their own rules because of their desire to catch the bottom or top of a move.

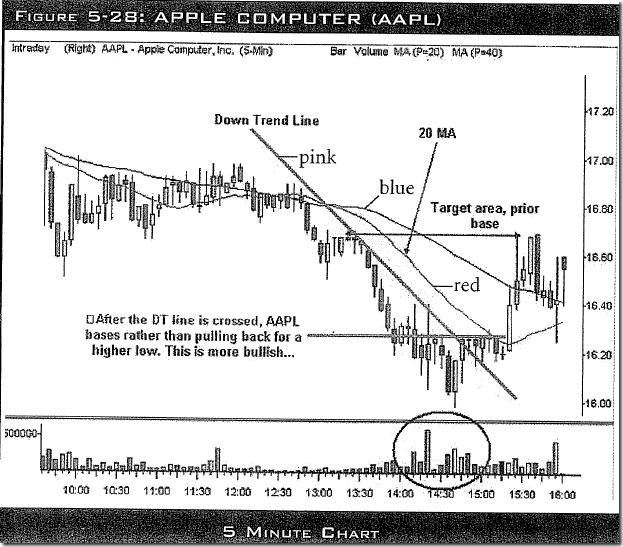

- Spot a trend with 8MA. Daily and Intraday down to 15-min chart. Trade ONLY in the direction of which side of 8MA closing price stays on. Use reversal signal on shorter-term chart to take profit not initiate trade.

- Spot daily trend with The Opening Price Signal: Last Price – Opening Price. The point in time when the signal changes from one side to the other is called the inflection point. Use inflection point as entry or stop-loss point.

Friday, June 15, 2012

Thursday, June 14, 2012

Traded RSU by accident, market moved too fast and caught me off guard

ES moved 8 points in 3 minutes, 13.5 points in 10 minutes. If I shorted ES, i would lose at least $400 in 3 minutes. If I stubborn overtrade, revenge trade, average up short, I would lose $1000 in this 10 minutes disaster. My equity would go below $25000. What a save!

Wednesday, June 13, 2012

Monday, June 11, 2012

Lessons in ES 3-min signal

Lesson 1: Earlier signal voided by later counter signal. Adjust stop level.

Lesson 2: Did you follow the trend.

Lesson 3: When trading in office, your vision and equipment are limited. You must trade small and less frequent.

Good Conduct#1: You didn’t revenge the market in the last half hour when in unexpected loss. If you did, $300 loss would become $600.

Good Conduct #2: Took the loss when it’s small. Took 2 ticks loss earlier after 2 ticks gain. Took a big loss in the last hour just before it became 3 times BIGGER!

Sunday, June 10, 2012

Tricks of the Active Trader

“What would you do if the sky was falling?”

“Sell the sky.”

“Need a friend? Buy a dog?” – Movie Wall Street

When you rearrange the letters in slot machines it becomes “cash lost in me.”

What’s your pain threshold. The pain threshold is the loss level at which you will close out open positions, cancel resting good-till-cancelled orders, and close your futures account. No one’s funds are unlimited.

Mini Index Future rough rule of thumb. If gap size is between the two, an equal chance of breakaway and common.

Method #1: 30-min H/L. If it’s hold, it’s breakaway gap. Not hold, it’s common gap (will be filled).

Method #2: Gap size

Method #3: NYSE tick readings. Can not exceed tick reading greater than +300 (<-300 for short) within the first few minutes. Common. Otherwise, breakaway.

Method #4: overnight H/L

Friday, June 08, 2012

Wednesday, June 06, 2012

Oliver Velez - Strategies for Profiting on Every Trade June 10,2012

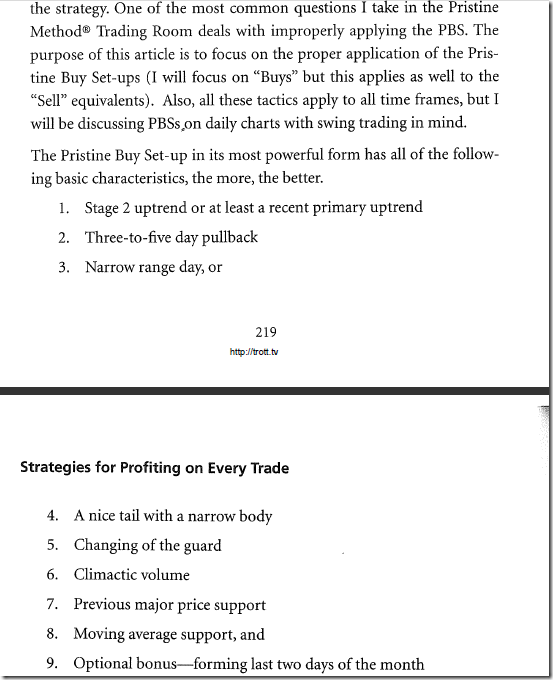

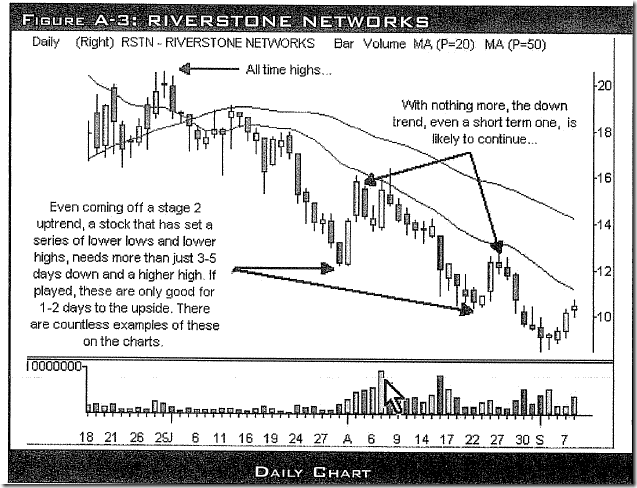

Quality of PBS

Elephant Walk

The fashion of 30-min BO.

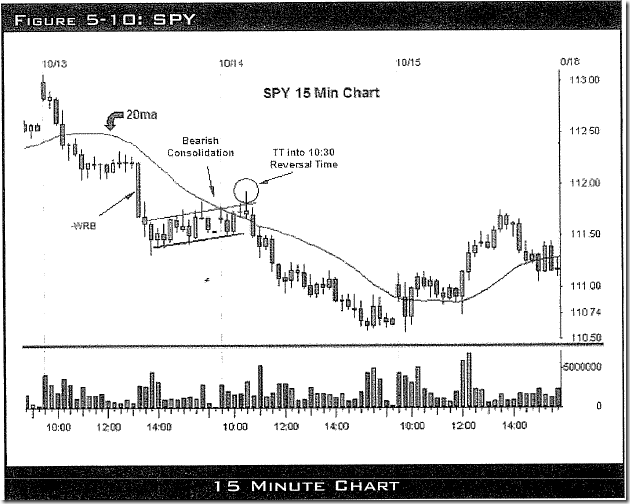

Put the above chart on the 15-min below, will scare you. It’s not a short but a long!

How to refine entry/stop in climatic setup (against the trend).

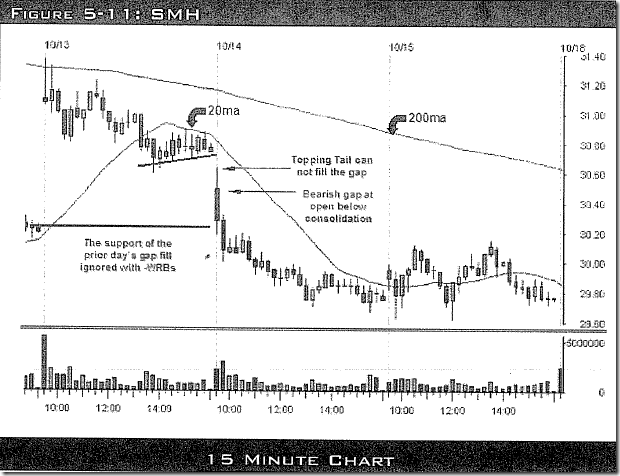

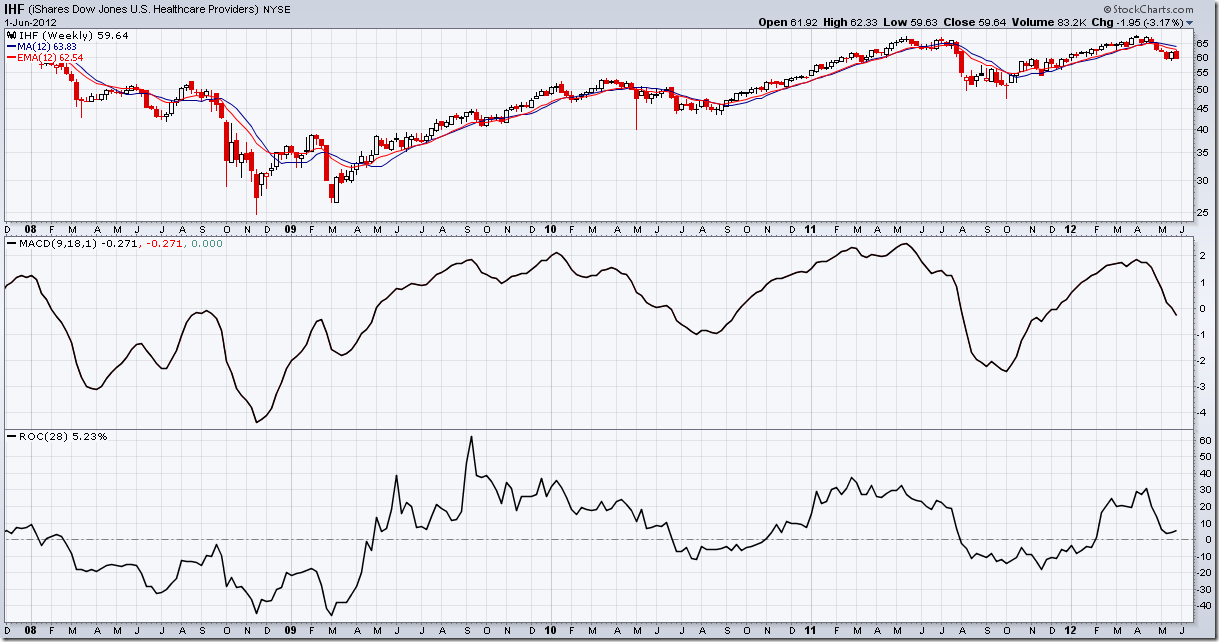

Relative Strength, Nasdaq->Semi sector->a stock in the sector.

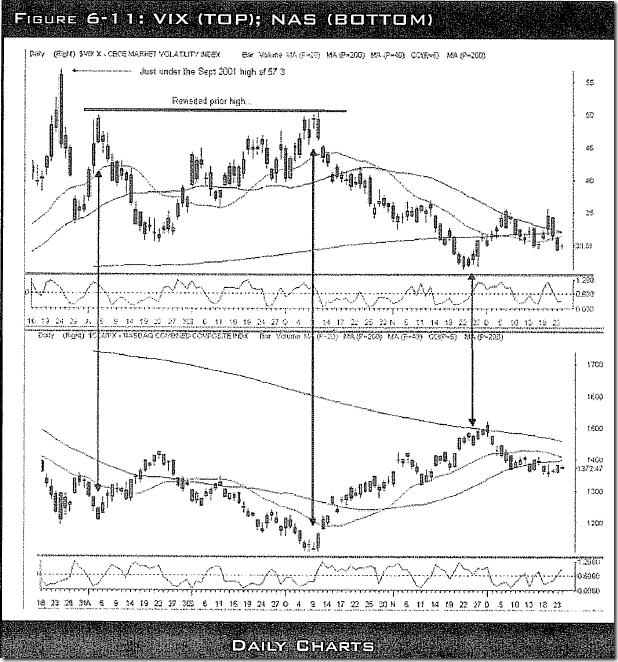

Use $VIX

![CropperCapture[2012-06-08-19-12-21-9711222] CropperCapture[2012-06-08-19-12-21-9711222]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjEmqSa8T8iPyUFaKbrCgK6VYeHyoF-wlQE0dK_gt4rRqQfMBgTU437Pw8QP4eMXwDYEeLedeEaQ1X6IXNe29Rc_QR6UrcK_Htf6OkKmxH3AjvbhasQBQsakdFUzv_XngIxWSPPtw/?imgmax=800)