Monday, December 30, 2013

Saturday, December 28, 2013

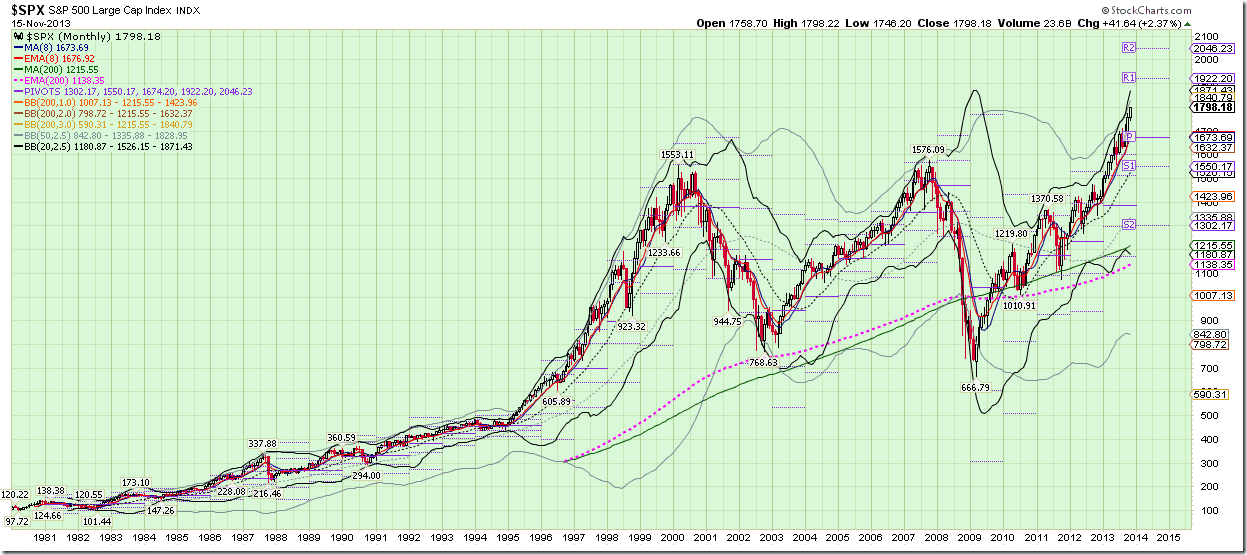

System 1 (G2): simpler, more practical

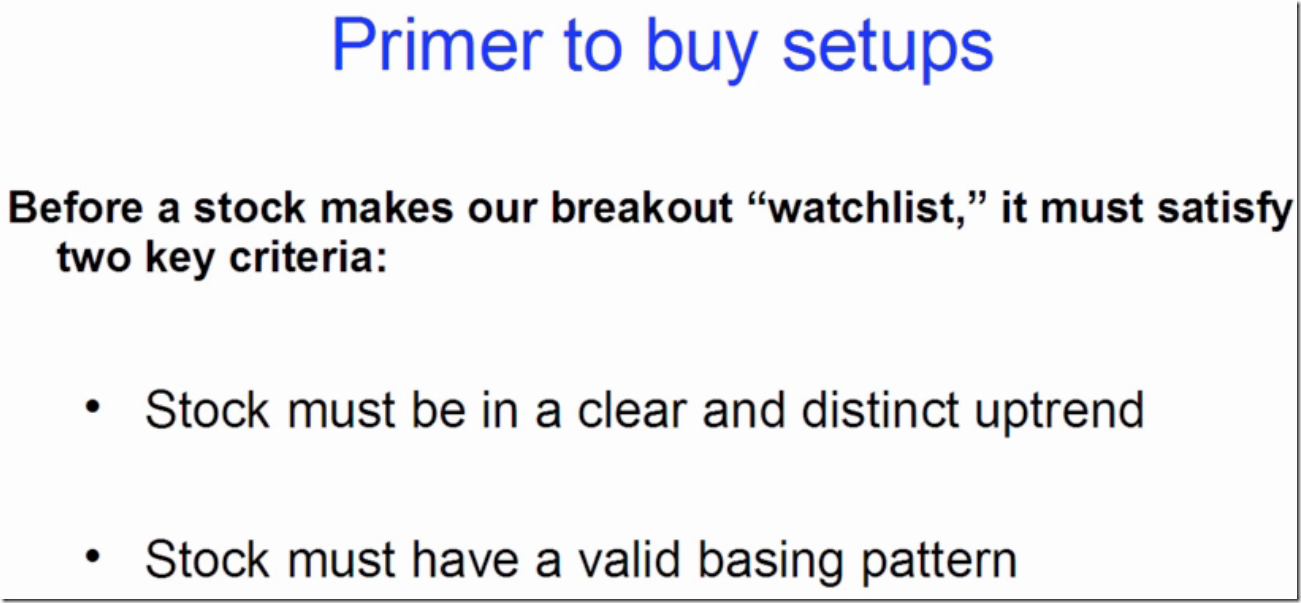

Read Big Trade by Peter Pham. Simplicity.

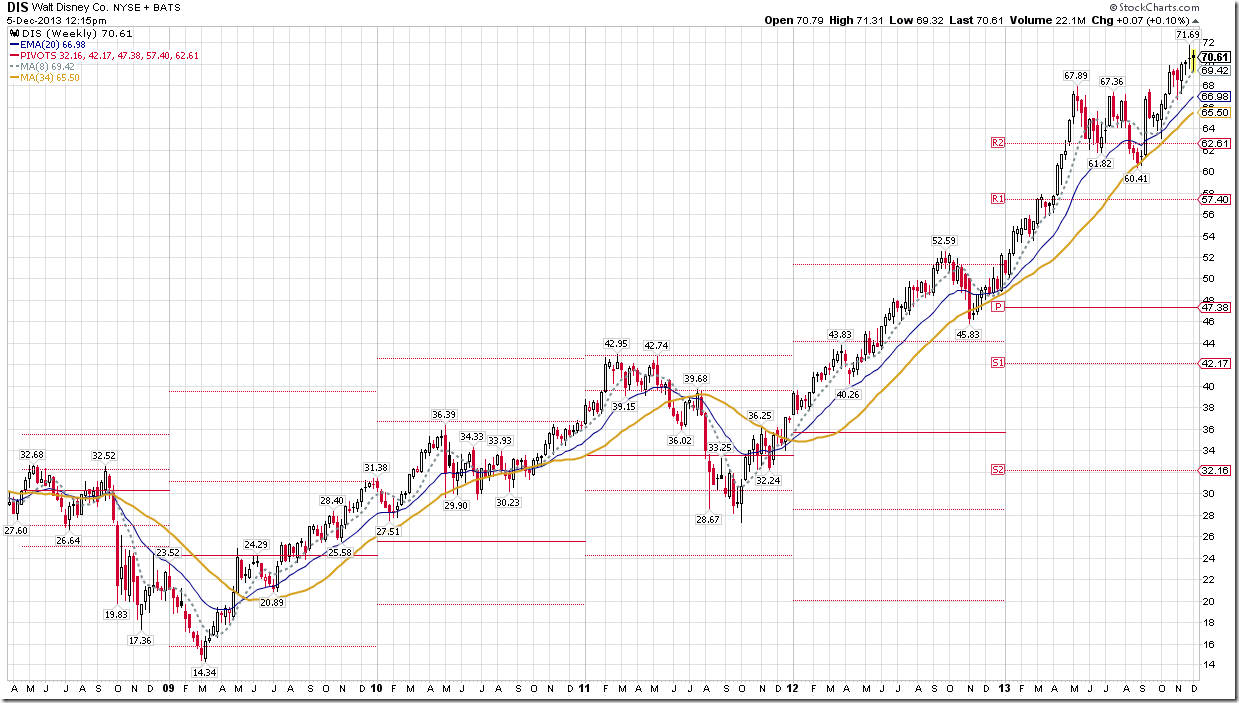

Abandoned pivots, artificial stuff.

Start using previous HL as reference points. previous C.

Start using opening range, previous O.

Start using inside bar (IB), outside bar (OB).

Interval collection: 1d, 1w, 2w(2w1,2w2), 3w(3w1,3w2,3w3), 1m, 3m, 6m(6m3,6m6), 1yr(1y3,1y6,1y9,1y12)

If target #1 reached, probability reaching target #2.

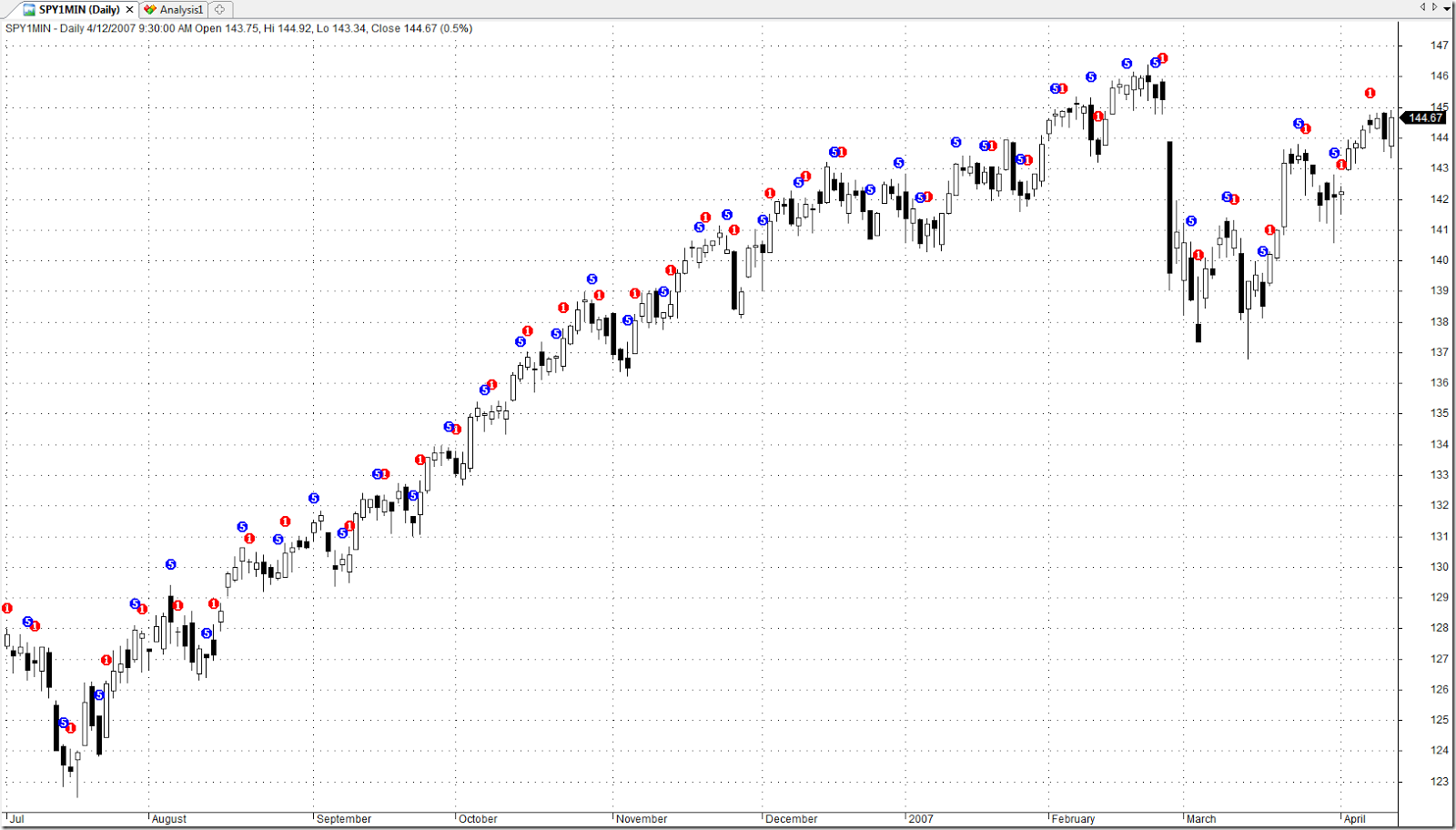

Use futures adjusted ETF data. Use 1min aggregated daily data.

Wednesday, December 18, 2013

Friday, December 13, 2013

Tuesday, December 10, 2013

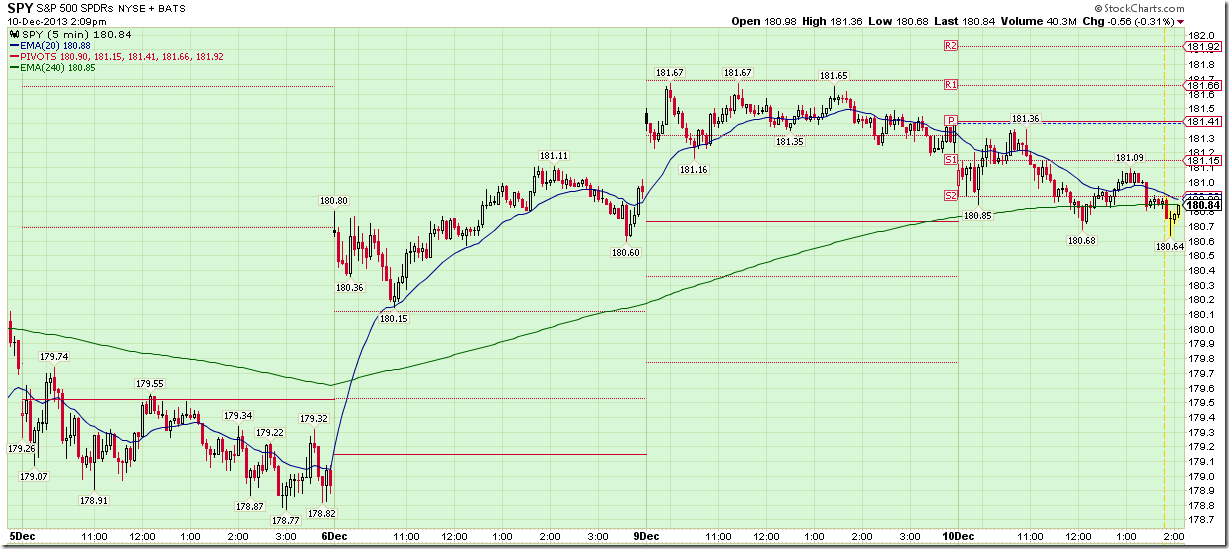

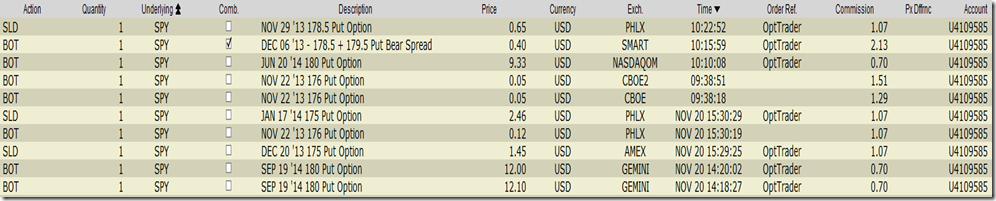

Do I need to roll over short 176 puts?

Dec 20 , 176 put delta = –0.18, SPY = 180.9

Option A: Roll over now with calendar spread +Dec13-Dec20 176, credit 0.42, net of comm $0.40.

Option B: Let Dec 13 176 expire worthless. Short Dec 20 176 on Dec 16. Dec 20 176 put is 0.49. As long as it doesn’t go down by 0.09, Option B is better than Option A. $0.09 decrease on options price means $0.50 increase on SPY’s price. Will SPY be higher than 181.4 by Dec 16?

Friday, December 06, 2013

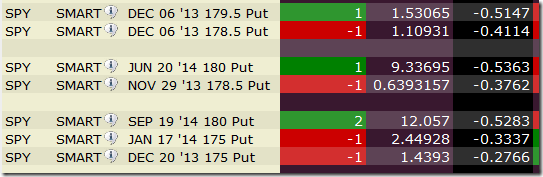

Hedge 179 on big gap up day

No matter 179 gap filled or not, 0.55 credit funded 0.43 put debit spread. with a longer term bearish bias. The same type of strategy was used on Nov 20 to play the 178.5 gap and made $63.

Thursday, December 05, 2013

Thursday, November 21, 2013

3 SPY spread Nov 20, Nov21

Friday, November 15, 2013

Tuesday, October 22, 2013

Friday, October 18, 2013

VXX strategy flaw and trade execution error

To close or flatten position, hit bid to sell long, hit ask to cover short

VXX was $100 and is $3.5 (split adjusted). It can go to sub penny theoretically. $VIX futures will likely floor at 10.

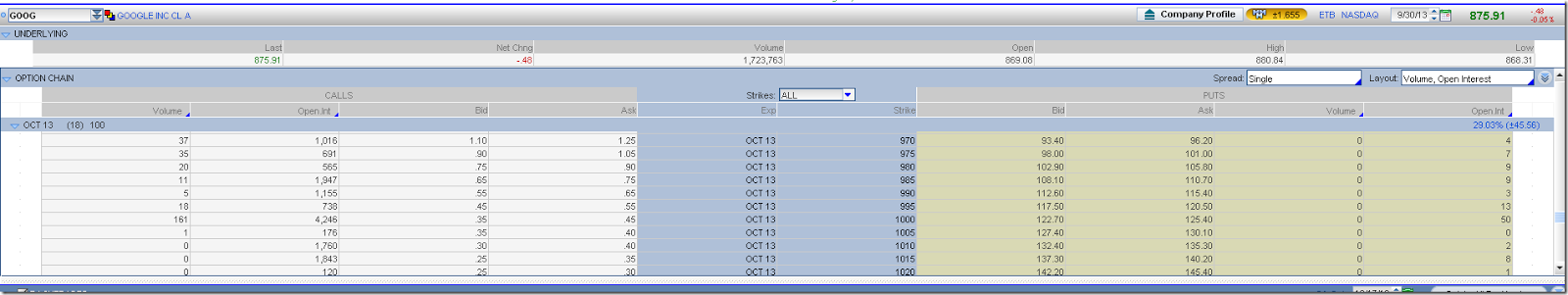

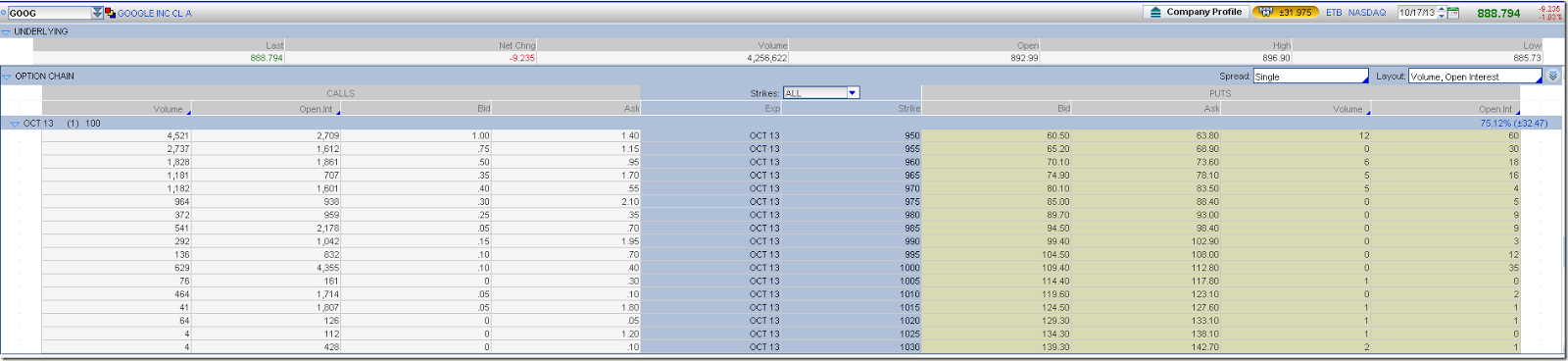

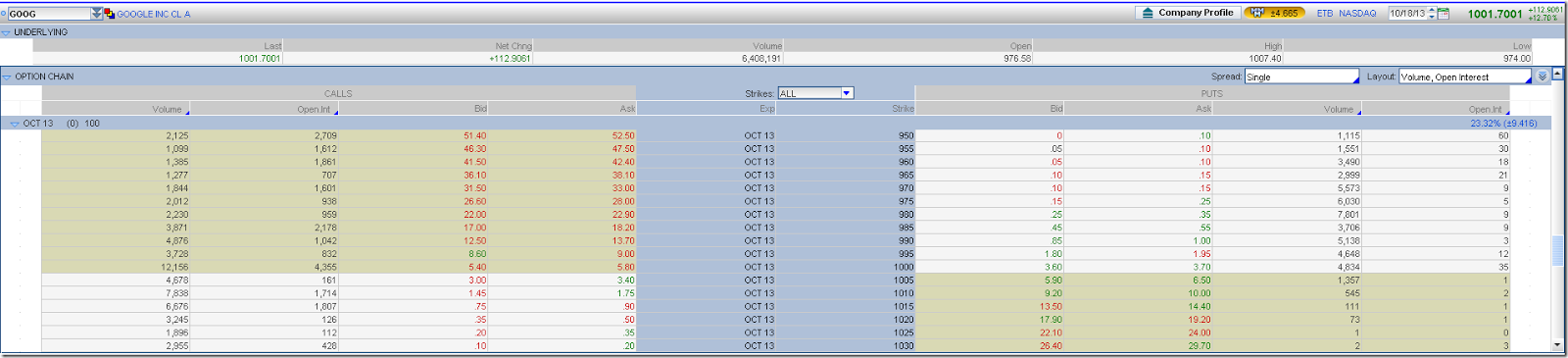

GOOG $1000 trade and chart options momentum play

First post after vacation. GOOD strong upside broke $1000. OI on Oct 18 1000 call has been very high since Sep 30. Smart money knew it.

$0.4 1000 call became $7.4 at open today

Market Maker move busted a lot of suckers. Iron Condor failed big!