Friday, March 29, 2013

Cdn stocks trading

-Scan all cdn stocks, Volume weekly surge 2+ folder, monthly surge 2+ folder;

-Based on the above two scans, new membership to my Cdn stocks universe;

-Scan my Cdn univ, monthly squeeze, weekly squeeze, daily squeeze, hourly squeeze, 30min squeeze, ema21 2d in a row, buy dip/sell rally ema8/21/55, bb50,2.

Thursday, March 28, 2013

Job Aid SCHacker

Watchout: image URL changes a few times in a day. Even PermaURL changes.

Copy template to a new file, e.g. permaURL _hot1_30m.txt. Open permaURL _hot1_30m.txt, modify first row.

First row: <file name without htm extension>,<refresh in millisecond>

Copy and paste to the rest of URL array from

Launch VB6

Open generated htm from FireFox

Wednesday, March 27, 2013

Tuesday, March 26, 2013

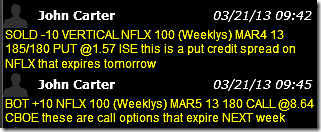

Thursday, March 21, 2013

Wednesday, March 20, 2013

Tuesday, March 19, 2013

SaferTrader.com Screening Stocks For Monthly Income Machine Credit Spreads

http://safertrader.com/stocks-for-monthly-income-machine-credit-spreads/

Note: Remember that we can use spread Strike Prices with one or two intervening strikes, i.e. we are not limited to adjacent Strike Prices for capturing sufficient premium.

Index/ETF*

DIA

GLD

IWM

NDX

QQQ

RUT

SPX

SPY

Stocks

AAPL*

AGN

AMGN

AMZN*

APA

APC

APOL

BA

BBL

BDX

BHP

BIDU*

BIIB

CAT

CELG

CLF

COH

COP

CREE

CRM

CTXS

CVX

DB

DE

DO

EOG

FDX

GLD

GOOG*

GS*

IBM*

LMT

MON

MOS

NEM

NFLX*

NOV

OIH

OXY

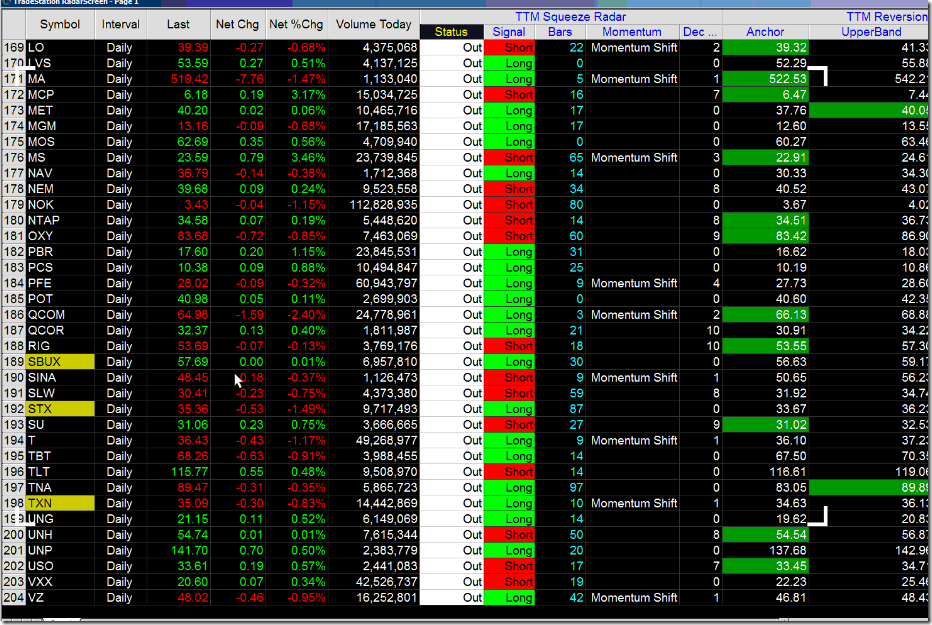

QCOM

SLB

TIF

V

VMW

WYNN

ZMH

* These underlyings are usually – but not always – a particularly good hunting ground for “entry rules” conforming underlyings.

Monday, March 18, 2013

YM trade during busy work week

| ym | indu | diff | |

| 9:30 | 14344 | 14388.8 | 44.8 |

| 9:59 close | 14393 | 14465.5 | 72.5 |

| 11:08 | 14401 | 14474 | 73.0 |

Friday, March 15, 2013

Thursday, March 14, 2013

vix and more

$VIX closes at 4:15pm and VXX closes at 4:00pm.

http://vixandmore.blogspot.ca/2010/12/chart-of-week-vix-support.html

http://vixandmore.blogspot.ca/2009/05/vxx-calculations-vix-futures-and-time.html

The VXX calculation is derived from the two nearest months of VIX futures. At the moment, this means the May futures and the June futures. For the sake of simplicity, I will refer to these as the front month and second month futures. I’ll explain the calculation with an example.

VIX options expire on Wednesday, May 20th this month (see 2009 expiration calendar), which means that at the close of business on the day before expiration, May 19th, VXX will hold exclusively the June VIX futures (VX-M9). As each calendar day passes, VXX will sell 1/23 (there are 23 trading days in the current VIX options expiration cycle) of the June VIX futures position and buy an identical amount of the July VIX futures, so that the percentage holdings of the front month and second month futures always create a synthetic blend of a basket of VIX futures with a constant maturity of 30 days. [Note that this is different from the calculations of the cash VIX, where the front month and second month options roll forward one month 8 days before VIX options expiration.]

As long as the near month and second month futures are similar in price, the daily rebalancing has little effect on the price of VXX. When the term structure has a steep slope and there is a substantial difference in price between the front month and the second month (as was the case with SPX options on 11/20/08), the daily rebalancing can generate its own profit and loss. As the graphic below shows, there was a 0.75 difference between the May and June futures settlement prices yesterday. Calculating 1/23 * 0.75, yesterday’s daily rebalancing probably resulted in a 0.03 change in price.

yeah... contango issue. no luv for vxx. it doesnt even look like good hedging tool. spike in vix must exceeds market's expectation for vxx to become truly hedging tool. if vix stablizes... vxx will continue to slide because of the rollover cost.

http://vixandmore.blogspot.ca/2008/06/unusual-chart-of-month-vxo-and-rvx.html

<<Trade What You See>> by Larry Pesavento

p6, Why Traders Succeed: Being in the habit of forgetting their last trade, win or lose, and moving on to the next trade.

p7, Each action you take repeatedly will become a habit.

p25, cloned lines not same as channel. Two examples below: one in the book; One from today’s real trading.

Index Stock Options - AM & PM Settlement

http://www.poweropt.com/am_pm_settle.asp

PowerOptions WeBlog - Investment Articles

Index stock options create investment opportunities for investors who wish to take advantage of market moves, as well as protect existing holdings. Offering known risk, the premium set by a long index option ensures the investor will not incur losses exceeding the purchase price of the index option. Investors can also take short positions with index stock options, but with the potential for unlimited loss in many cases. Additionally, an index credit spread stock options position, short an index option and long an index option with the same expiration month, gives investors an opportunity to pursue leveraged investments without paying interest fees for margin as with other leveraged strategies. However, the risks associated with credit spreads on indexes must be carefully considered.

Broker Exercise Procedure

Index stock options attach strict details when purchased, particularly the expiration date, and more specifically an hourly deadline to exercise the stock options. When purchased by the investor, the stock options expire at this set time and date, unless exercised, or sold prior to expiration. Due to the fact that different deadlines can be established and set instructions are defined for the expiration of the index option on the last day of trading, investors should become familiar with their broker's exercise procedures. Broker stock options exercise procedures can vary from broker to broker and missteps related to stock options exercise can be very costly.

American vs. European

It should be noted that stock options on certain indices are classified by either the {American option} style or the {European option} style. In the case of American-style stock options, the investor maintains control over the right to exercise, or sell, the stock options at any time before or at the specified time on its expiration date. Failure to exercise an American-style stock option will result in the expiration of the option as a financial instrument, basically rendering it worthless as it ceases to exist.

European

European style stock options specify a strict time period for exercising the stock options prior to expiration. Within the assortment of different European style classes, the period varies or in some cases does not allow the exercise of the stock options prior to expiration.

Index Option Settlement

Details of an index option's sale and expiration can be determined in a variety of ways, but the two most common are an AM Settlement and a PM Settlement. Like the hours of the day, these exercise settlements reflect the opening numbers and closing values of the day's trading. To avoid surprises on the Friday of stock options expiration, the issues associated with the individual settlement styles require careful handling.

PM Settlement

A PM Exercise Settlement establishes its value at the close of the market, when the last reported prices for the individual stock components are calculated to determine the index's value. Most ETFs are PM Settlement, including the most favored {QQQ}, {SPY}, {IWM} and {DIA}. A well-known index with PM settlement is the S&P100 Index ({OEX}).

AM Settlement

AM Exercise Settlement is established by calculating the opening prices of the individual component stocks of an index and thus the index option is exercised or sold based on that value. The S&P 500 Index (SPX) covering a broad range of industries is a commonly known AM Exercise Settlement index option.

AM Settlement Delayed

AM settlements are susceptible to certain glitches in the system of reporting, as the opening value of the index is the respective opening values of all of the stocks of the index. But sometimes a stock may not actually trade for several hours or may not trade at all on a given day, delaying the calculation of the final settlement value.

AM Settlement Potential Gottcha

With an AM settlement, index options stop trading the day before expiration. Most often the investor can sleep soundly as large moves in the index seldom occur between Thursday afternoon and Friday morning. Unfortunately, should an adverse change in the value of an index with AM settlement occur between Thursday's close and Friday's open, an investor could experience a very disappointing loss after a gain appeared certain on Thursday afternoon. Additionally, since index options stop trading for AM settled indexes at Thursday's market close, an index option investor basically becomes a captive to the index option with AM settlement after the market closes on Thursday. There's no way for an investor to exit an index option with AM settlement after Thursday's market close, yet the underlying index is subject to change. A market-moving event occurring after Thursday's market close can significantly move an index on Friday causing potential heartburn for index option investors.

AM Settlement Risks with Index Options

Investors trading index option credit spreads should be very careful in trading index options with AM settlement as sudden moves between Thursday's close and Friday's open can turn a sure gain on Thursday into a very big loss on Friday. An example of an index AM settlement causing heartburn for index option credit spreads for the Russell 2000 Index ({RUT}) occurred in August of 2008.

AM Settlement Example with RUT

The RUT closed on Thursday, August 14 at 754.38 and according to the stock chart/ticker tape the RUT had an opening price of 759.26 on Friday, August 15. Since the RUT is AM settled, it would appear that any bear-call credit spreads position with a short call option strike price greater than 759.26 would be 100% profitable, i.e. 760, 765, 770, etc. However, the final settlement value for RUT was determined to be 765.07 - almost 6 points higher than indicated by the opening stock chart/ticker tape value. With the 765.07 settlement value for RUT, all of the bear-call credit spreads positions with a long call strike price of 760 are now much less profitable than previously thought. As an extreme example, the bear-call credit spreads position for the strike price combination of the 760/770 went from profitable on Thursday afternoon to a loss of approximately 50% on Friday.

What to Do About AM Settlement and Index Credit Spreads

The best answer as to what to do about AM settlement and index credit spreads is to either avoid index options with AM settlement or to simply exit the position on Thursday if the short option strike price is "close" to the value of the index. An investor deciding to exit a "close" position early, must decide on a value for when the index is "close" to the strike of the short index option. One way to determine "close" is to evaluate historical movements of the AM settled index between Thursday's close and Friday's settlement value.

Historical Analysis of AM Settlement

Using PowerOptions powerful historical back testing took, a historical analysis from May 2006 to August 2008 of Thursday's close values versus the settlement prices for AM settled indexes revealed some surprising results. Tables of the maximum percent changes, increase and decrease, between Thursday's close and Friday settlement for several AM settled indexes are shown below.

Even though the average index value changes from Thursday's market close to Friday's settlement are approximately 1% or less, there are some very significant outlier cases where the change in the value of the index was very significant. For example, the largest percentage movement as illustrated in the tables from Thursday close to Friday settlement during the time period was the RUT index. The RUT index experienced a very large +4.4% movement from Thursday's market close to Friday's settlement in August of 2007. The next largest movements of the RUT were much smaller and were experienced in March of 2008 at +2.1% and June of 2007 at +2.0%.

Conclusion

Investing in credit spreads for index options with AM settlement must be carefully considered. In general, if an index value is within 2% to 3% of the short strike of an index option credit spread on the Thursday before Friday stock options expiration, an investor should carefully consider exiting the position early on Thursday. Even if the value of the index is within 4% of the short strike of the index options credit spread on Thursday before Friday stock options expiration, an investor should be a little nervous. PowerOptionsApplied uses index options for its Iron Condor related products. An Iron Condor position is a combination of a bull-put credit spread and a bear-call credit spread on the same underlying. For example, to prevent issues related to AM settlement, PowerOptionsApplied selects initial Iron Condor positions with a wide distance between the index value and the short index option's strike price. PowerOptionsApplied also uses generous stop-loss values for exiting Iron Condor positions. Additionally, PowerOptionsApplied carefully monitors its AM settled index Iron Condor positions for exiting early on the Thursday before stock option expiration on Friday if the value of the underlying index is close to either of the short index option strike prices.

Wednesday, March 13, 2013

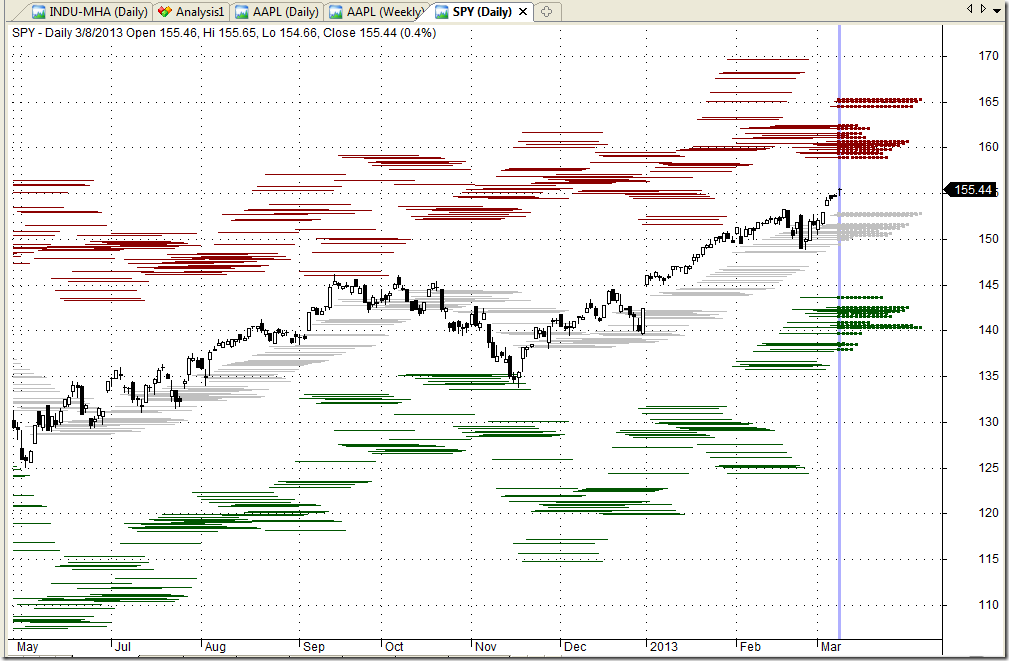

Bet SPY won’t reach 170 by Oct 1

Sold 3 calendar spreads. Sold Sep 30 170 call and bot May 17 170 call @0.06 to hedge. 0.68,0.68,0.69. Dividend adjusted, would be 168. Monthly pivot cloud. Last breach was by 4 red lines in May 2011. By projection, 5th line in Sep is at 170.