Saturday, April 27, 2013

Edge

Yes: proprietary info, statistics, confluence of several signal from "No edge" categaory.

Tuesday, April 23, 2013

Sunday, April 21, 2013

Perry Kaufman's new book 5th edition

The most robust systems are the ones that work in the most markets over the longest time period with the same rules and parameters.

Friday, April 19, 2013

Wednesday, April 17, 2013

Sunday, April 14, 2013

<<Invest to Win>> Vola and safety-seeking indicator, $UTIL

http://gainsmaster.com/read-the-market-mood/

Reading the market mood is quite simple once you get used to the charts. The two important conditions you must observe are as follows:

1) The comparison between the S&P 500 index and the Dow Jones Utility Stock index.

For this condition you are trying to answer this question: which group of stocks to investors appear to prefer more right now, utility stocks or regular stocks? You must compare the difference between these two indexes over the last two months on a chart that shows a year of data or more. The two possibilities are that either utility stocks are doing better or that the S&P 500 is doing better.

2) The general trend of market volatility.

This condition tracks whether market prices are changing with a greater degree of fluctuation. To determine this you will track the Average True Range (ATR). You must observe the general slope of the ATR and try to determine its trend over the most recent two months. The two possibilities are that the ATR is rising or falling.

Once you have identified these two conditions, then you can use the combination of them to tell you whether the market is giving a GO or a STOP sign.

GO sign (price has crossed above the 12-month moving average)

Condition 1: The S&P 500 index is outperforming the Dow Jones Utilities Index over the past two months

Condition 2: The ATR is falling over the last two months.

STOP sign (price has crossed below the 12-month moving average)

Condition 1: The Dow Jones Utilities index is outperforming the S&P 500 Index over the past two months

Condition 2: The ATR is rising over the last two months.

SC hacks

{"longUrl": "http://stockcharts.com/h-sc/ui?s=SPY&p=5&b=2&g=1&id=p18273350545", "shortUrl": "http://scharts.co/104881U", "symbol": "SPY"}http://stockcharts.com/h-sc/ui?s=SPY&p=5&b=2&g=1&id=t18273350545&r=1364502335301&cmd=getlinkableversion

Saturday, April 13, 2013

Friday, April 12, 2013

Thursday, April 11, 2013

Wednesday, April 10, 2013

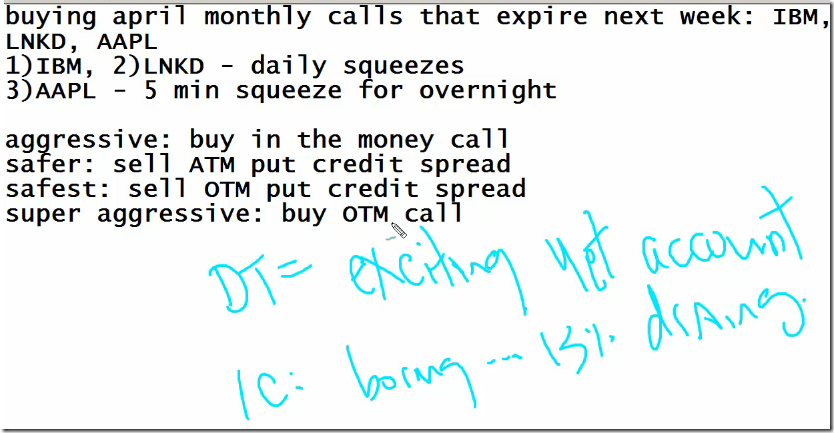

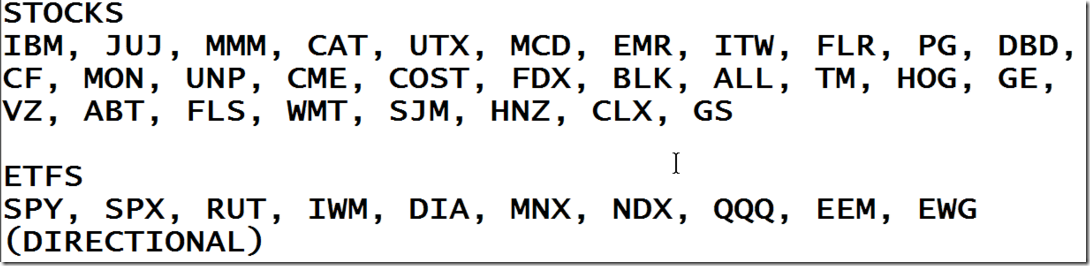

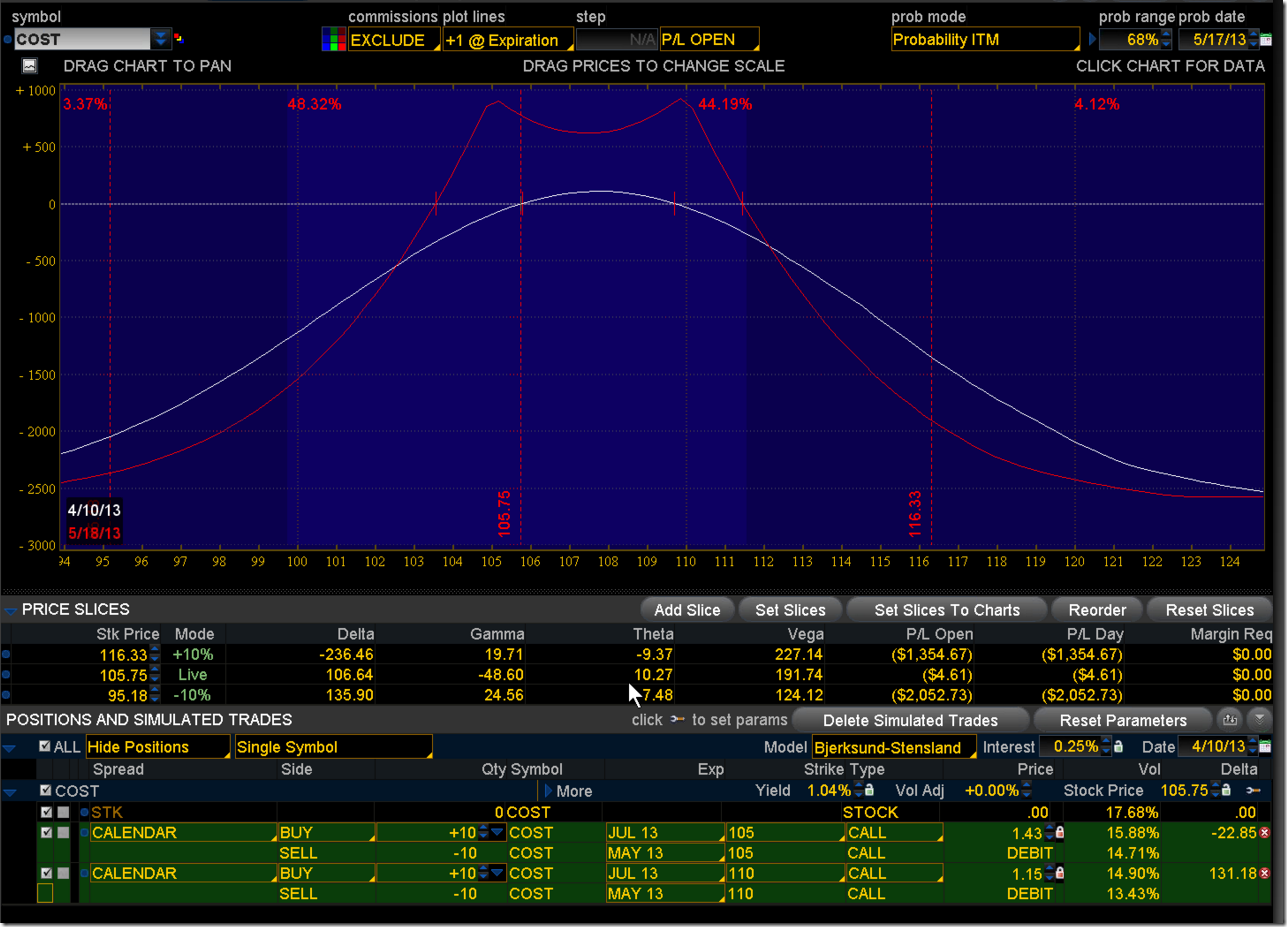

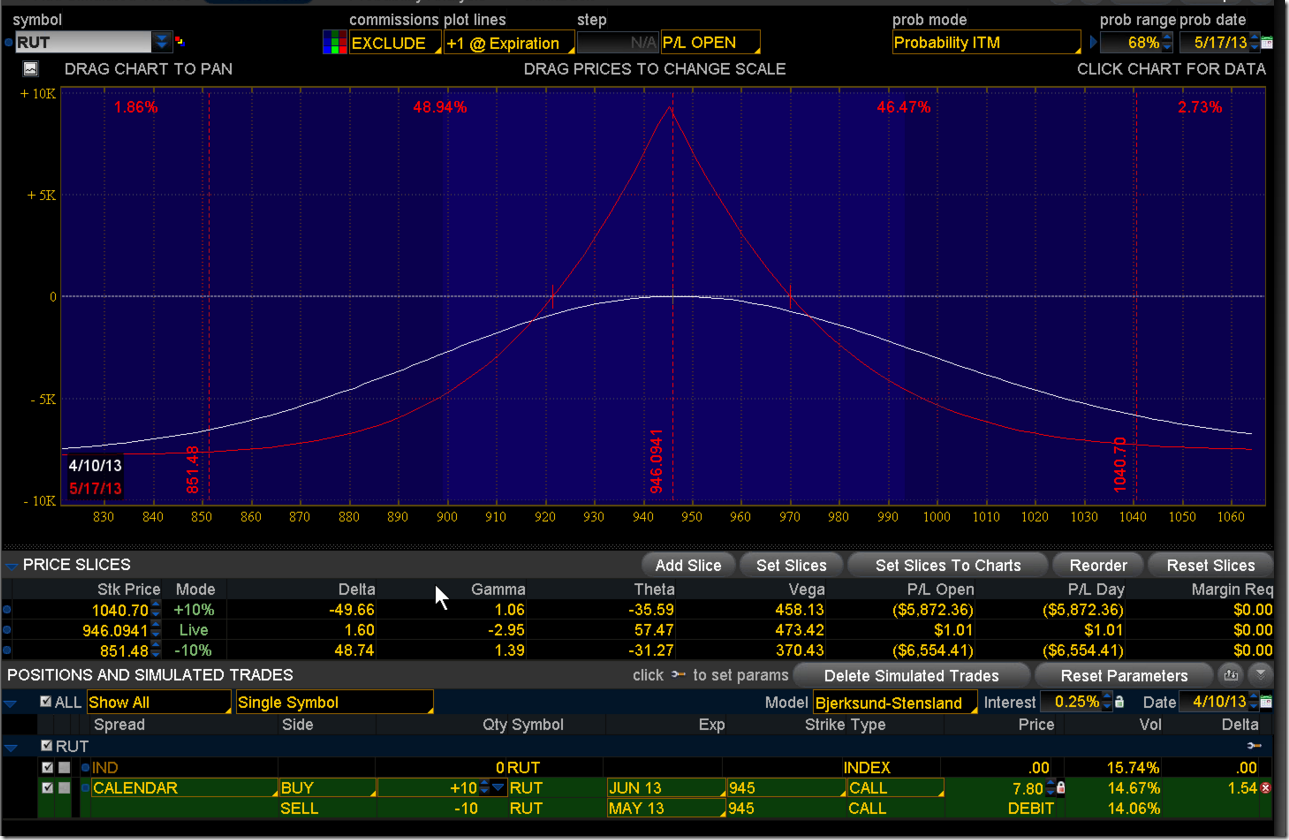

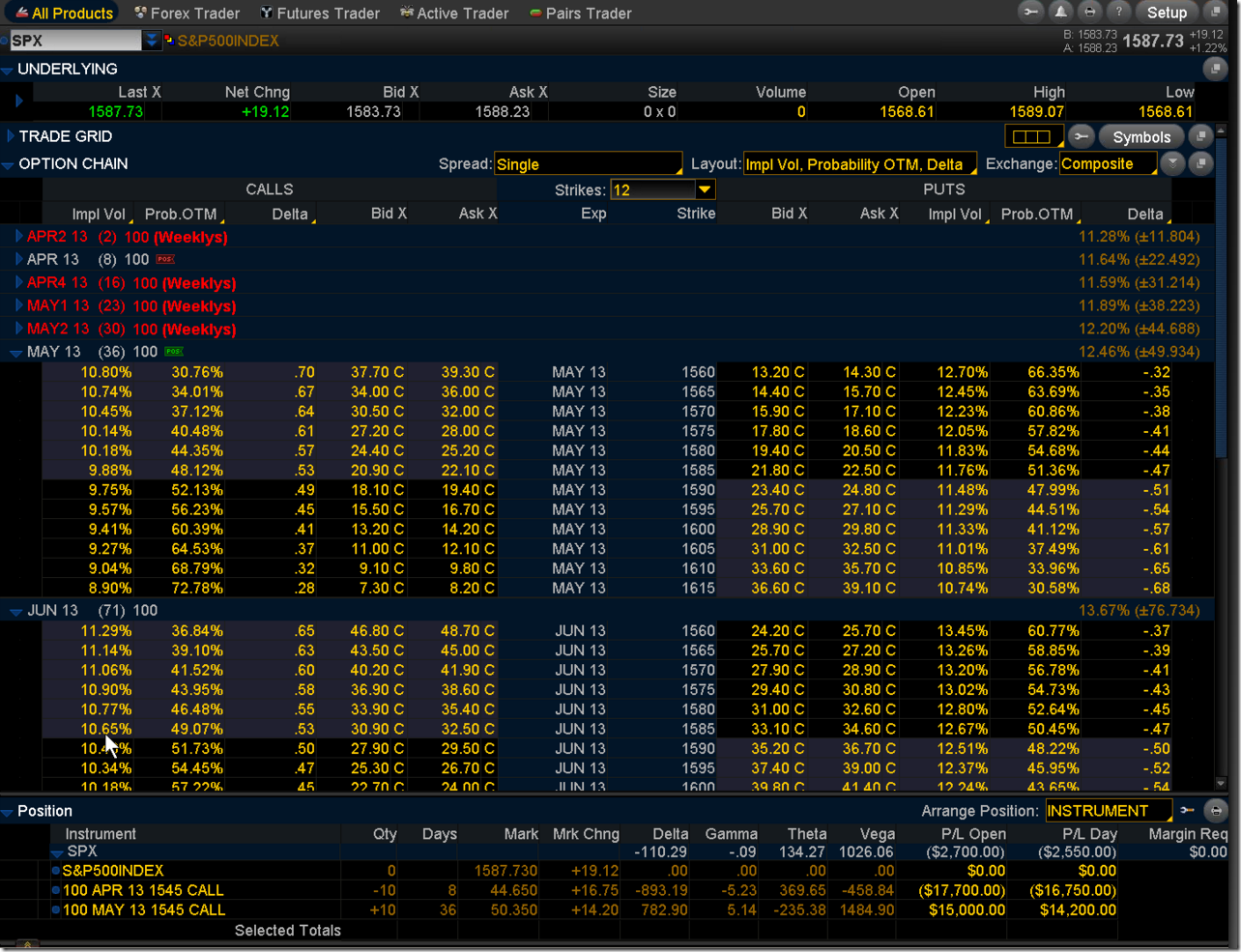

Boring Income Class, 7 step process

Need boring stocks IBM,JNJ,MMM,FLS

30 (or 35) days out, take out 10~12 days later

let the MM work for 10 minutes. Or raise 3 cents

Vola skew<=2%, rule of thumb.

7 Step Process