Monday, May 27, 2013

Friday, May 17, 2013

Friday, May 10, 2013

Thursday, May 09, 2013

Wednesday, May 08, 2013

Monday, May 06, 2013

Saturday, May 04, 2013

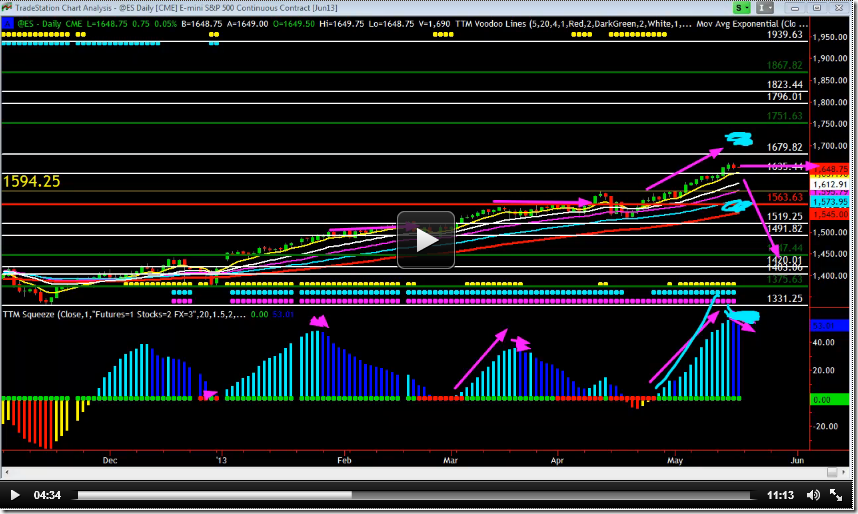

The morning of the day when SP made 1600

It's 7:45am, May 3, 2013 before employment report hit the wire. Several veteran traders already predicted accurately.

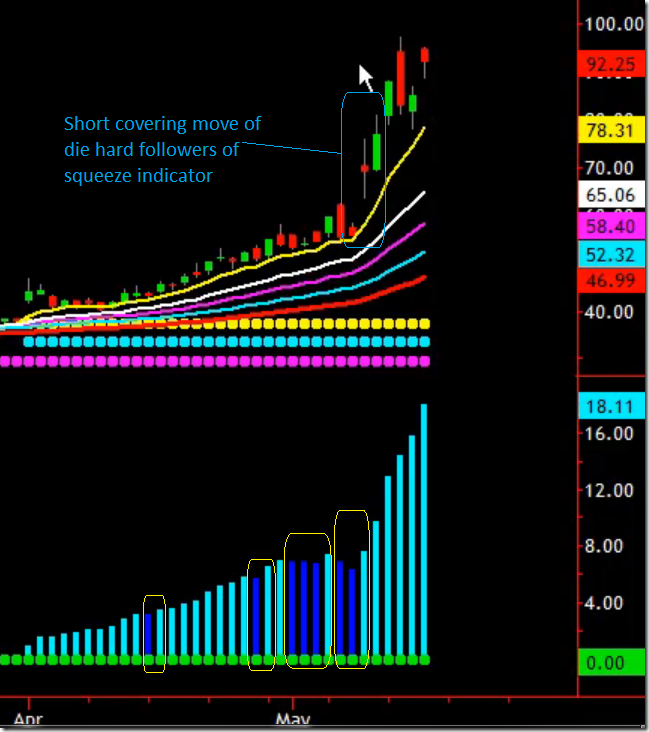

Thursday’s market was the usual: NEW HIGHS despite bad news. The S&P notched new records because the European economic situation is so bad that Super Mario of the ECB cut interest rates. The foolish among us who short the Stalingrad & Poor 500 for long periods of time covered, which sent it higher.

Friday’s market moves may be influenced by the monthly employment data – especially if it is bad. After all, since bad is now good, Fraud Street will be pricing in more QE from Chairman MaoNanke…and buy. If it is as-expected, then it’s not bad so they will buy. And if it is good, Fraud Street will exclaim that it must mean the terribly-bad job market is over…and buy.

Either way, it should trade to 1,600.00 and perhaps higher. The only thing that matters is more and more “stimulus.”

Thursday’s market was the usual: NEW HIGHS despite bad news. The S&P notched new records because the European economic situation is so bad that Super Mario of the ECB cut interest rates. The foolish among us who short the Stalingrad & Poor 500 for long periods of time covered, which sent it higher.

Friday’s market moves may be influenced by the monthly employment data – especially if it is bad. After all, since bad is now good, Fraud Street will be pricing in more QE from Chairman MaoNanke…and buy. If it is as-expected, then it’s not bad so they will buy. And if it is good, Fraud Street will exclaim that it must mean the terribly-bad job market is over…and buy.

Either way, it should trade to 1,600.00 and perhaps higher. The only thing that matters is more and more “stimulus.”

Friday, May 03, 2013

Subscribe to:

Comments (Atom)