Monday, December 30, 2013

Saturday, December 28, 2013

System 1 (G2): simpler, more practical

Read Big Trade by Peter Pham. Simplicity.

Abandoned pivots, artificial stuff.

Start using previous HL as reference points. previous C.

Start using opening range, previous O.

Start using inside bar (IB), outside bar (OB).

Interval collection: 1d, 1w, 2w(2w1,2w2), 3w(3w1,3w2,3w3), 1m, 3m, 6m(6m3,6m6), 1yr(1y3,1y6,1y9,1y12)

If target #1 reached, probability reaching target #2.

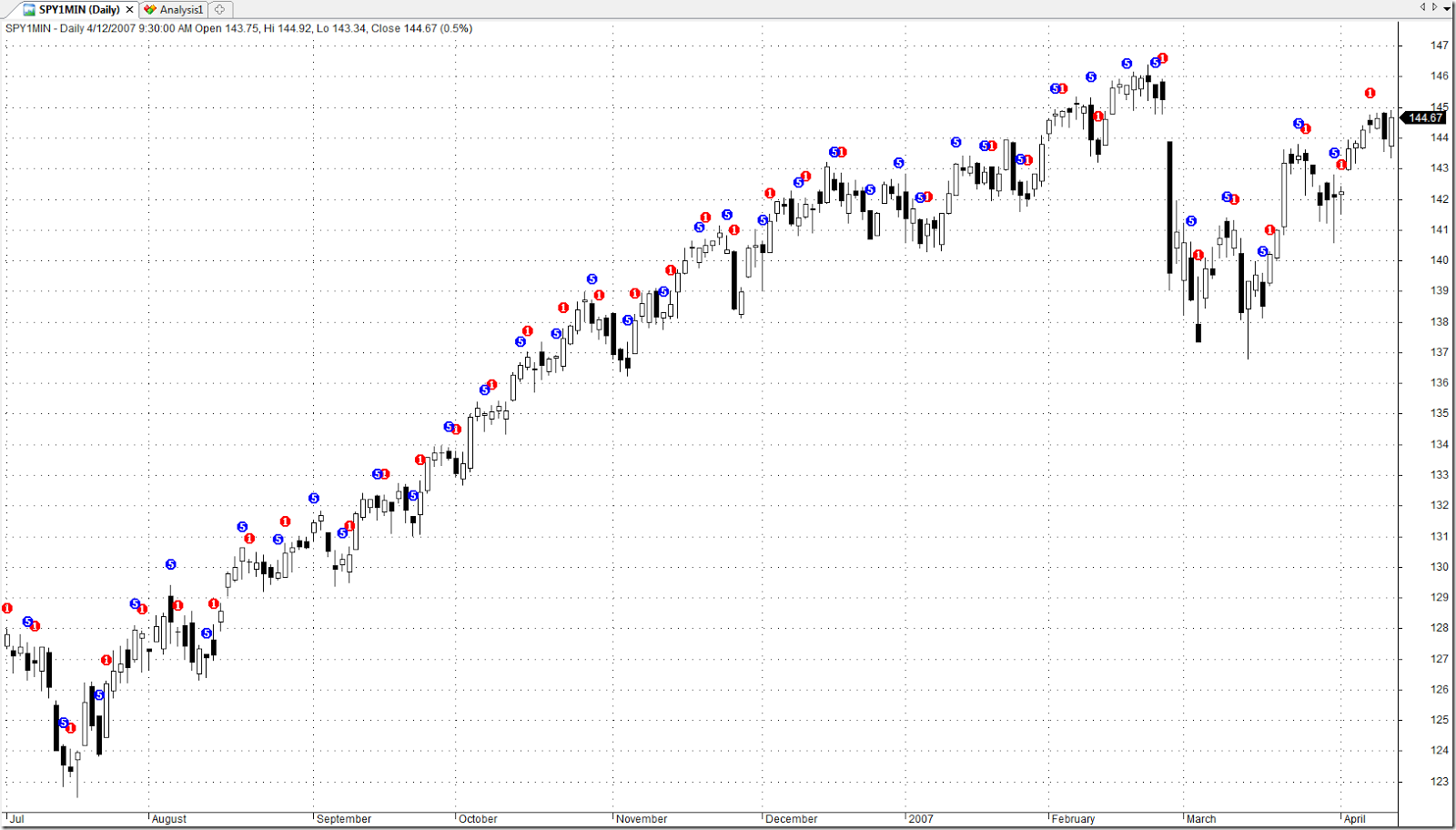

Use futures adjusted ETF data. Use 1min aggregated daily data.

Wednesday, December 18, 2013

Friday, December 13, 2013

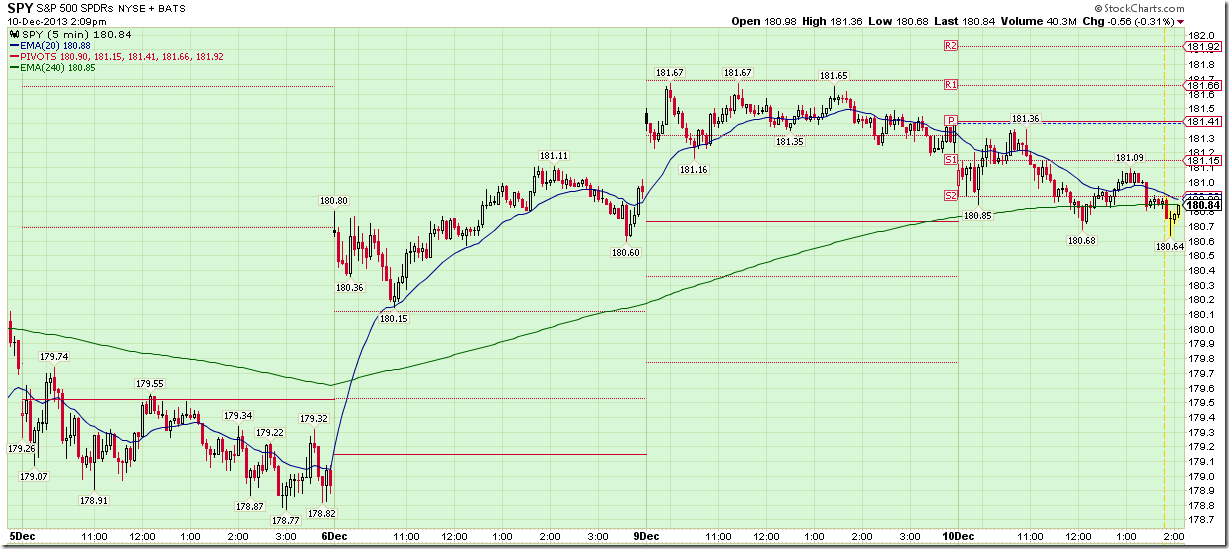

Tuesday, December 10, 2013

Do I need to roll over short 176 puts?

Dec 20 , 176 put delta = –0.18, SPY = 180.9

Option A: Roll over now with calendar spread +Dec13-Dec20 176, credit 0.42, net of comm $0.40.

Option B: Let Dec 13 176 expire worthless. Short Dec 20 176 on Dec 16. Dec 20 176 put is 0.49. As long as it doesn’t go down by 0.09, Option B is better than Option A. $0.09 decrease on options price means $0.50 increase on SPY’s price. Will SPY be higher than 181.4 by Dec 16?

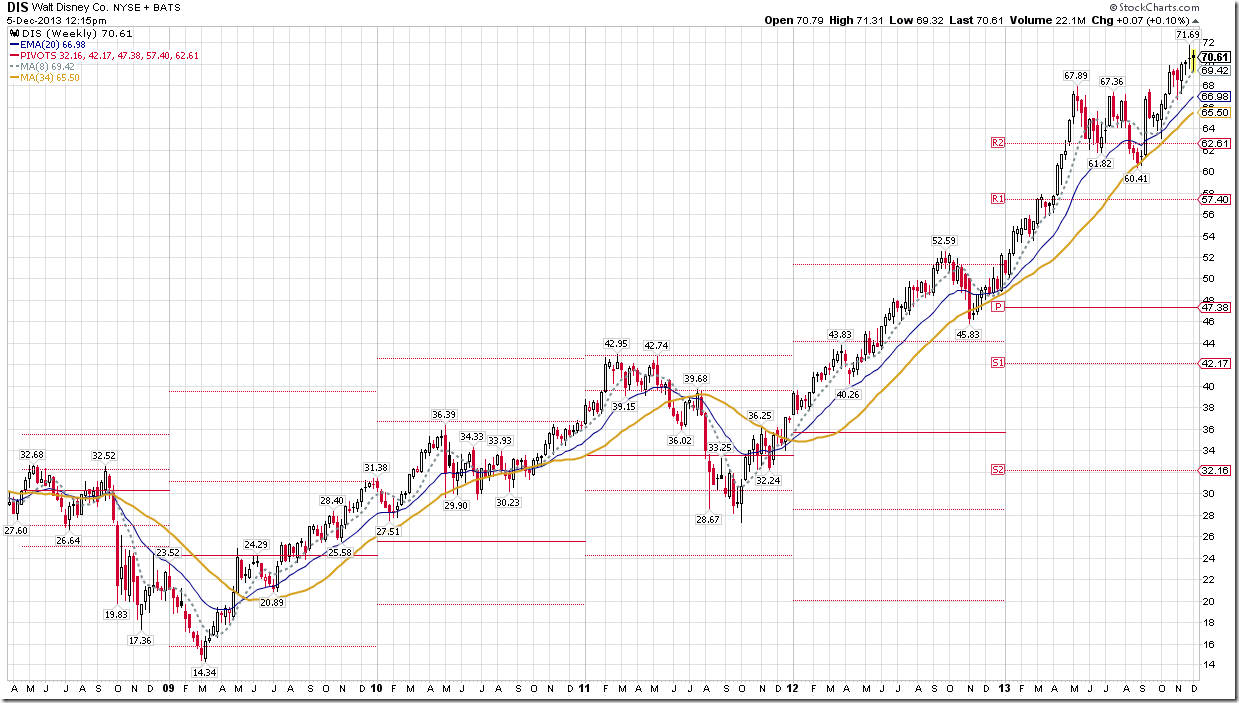

Friday, December 06, 2013

Hedge 179 on big gap up day

No matter 179 gap filled or not, 0.55 credit funded 0.43 put debit spread. with a longer term bearish bias. The same type of strategy was used on Nov 20 to play the 178.5 gap and made $63.