Spiders = [SPY US Equity], index = [SPX Index]; Obviously spiders have 10x smaller notional, but for institutional sized trades, any practical differences?

1 Answer

Arnav Guleria, Quantitative Derivatives Trader/Marke...

1 vote by Arun Narasimhan

ETF options internalise decreased transaction costs and increased tracking risk when compared to index options. Additionally:

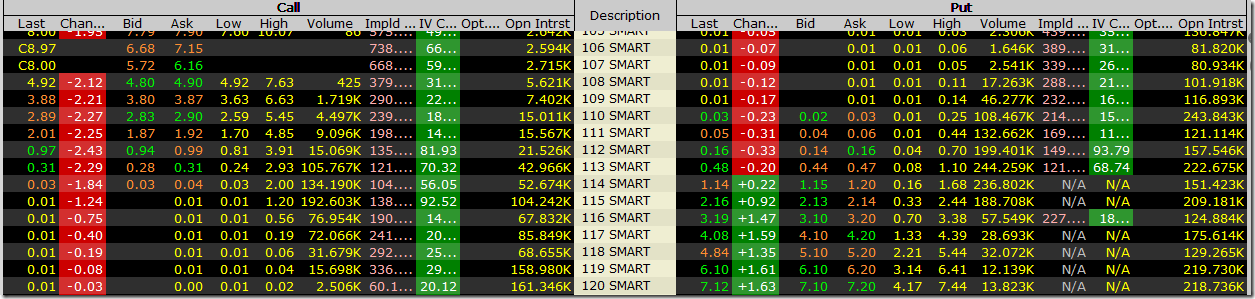

- SPY options have smaller contract sizes than SPX options ($120 000)

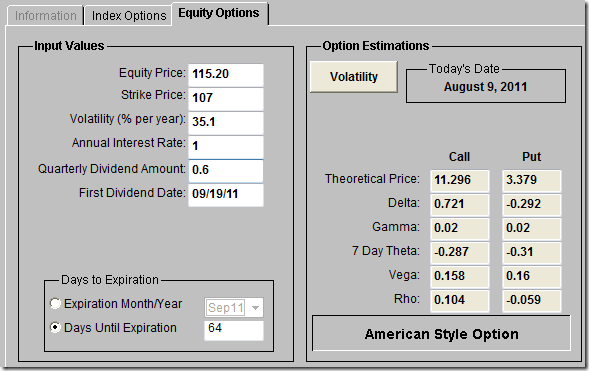

- SPY options are American-style (allow early exercise) versus SPX options which are European-style (no early exercise)

- SPY options are physical delivery versus SPX options which are cash delivery

Indices versus ETFs

Let's step back and evaluate the difference between an index and an index ETF. An index is a statistical measure of changes in a representative group of data points. Thus, the S&P 500 Index (SPX) is simply a statistic that can be calculated at any time by anyone given the underlying stock prices.

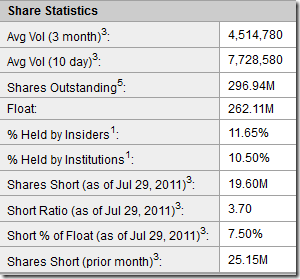

An ETF such as the S&P 500 SPDR (SPY) tracks the SPX in an easily trade-able form. It is subject to tracking error, where the SPY deviates slightly from the SPX. Practically, given the SPX and SPY's liquidities, the tracking error is generally very small (but occasionally noticeable).

Shortest course in delta hedging

Now let's look at how options are priced. Briefly, an option can be synthetically replicated through a blend of stock and cash. This is how dealers price options in the markets. Thus, when "manufacturing" options without exposure to price movement, i.e. while holding a delta neutral portfolio, options market makers have to transact in the underlying stock.

It's cheaper to deal in ETF options than index options

Now let's re-visit your original question.

If I'm a dealer and have to make a market in SPX options, it means transacting in all of the underlying stocks every-time I re-hedge, having to choose a sample of those stocks in the hope that it will sufficiently correlate with the entire portfolio (trading transaction costs for tracking risk), or trading the ETF and eating the tracking error. To help deal with this, index options generally settle in cash (SPX options do).

If I'm a dealer and have to make a market in SPY options, I just trade the underlying ETF. What if the ETF has a 50% tracking error? I don't give a crap. If it comes time to deliver, I deliver the ETF, tracking error be damned.

Thus, SPY options internalise the tracking issues on the ETF side and cruise smoothly on the options side. Additionally, if one is an AP (authorised participant), it can be handy to be delivered the ETF, which is exhangeable into shares, instead of cash. Finally, the open interest in SPX options far exceeds that available for the SPY options.

Note regarding settlement differences

It should also be noted that settlement procedures differ between stock options (which ETF options live under) and index options, e.g. the latter are settled given the opening price on the third Friday of the index versus ETF options which typically use the closing price.