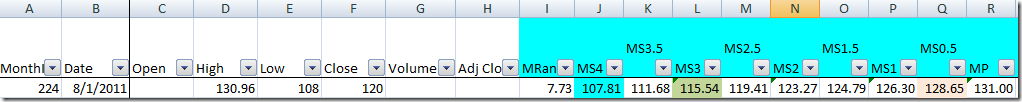

To capitalize it, game plans are as follows: Bet small. 1 pair for each strategy! Close all position by Aug 19. When price penetrates 107.81, the entire 3 trades are invalid. liquidate immediately.

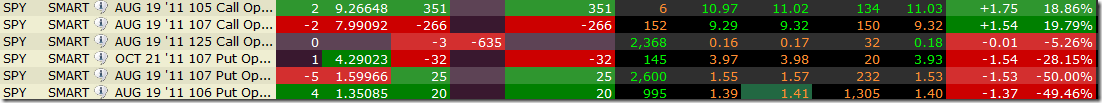

1. Sell Aug 19 107 put and buy Aug 12 110 put. Free insurance for the week. After a 2nd thought, not worth it. Will apply on Sep 30 options next month.

2. Credit put spread Aug 19 -107 +105, or -107+104. Need calculation. Look for the best ROI = credit/initial margin

- Aug 9: 0.18, 0.17, 0.16, 0.16 via managed accumulation. By default, it was 0.14~0.15 per spread.

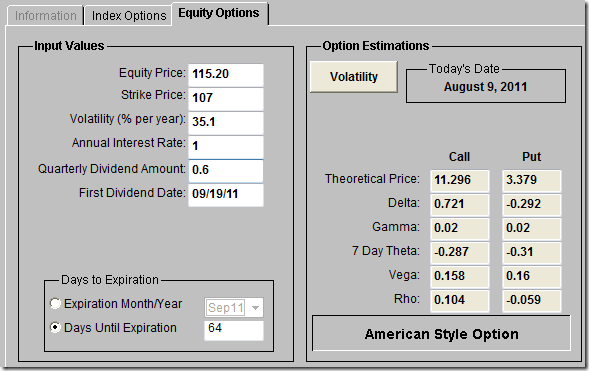

- The calendar spread: Oct 107 put 4.28, Aug 19 107 put 2.01. Spread cost: 2.27. Model says I could expect $1.00 net per spread on Aug 19.

3. Debit call spread Aug 19 +106 –107, or +105-107. Need calculation. Look for the best ROI = credit/initial margin

4. Naked short put option Aug 19 107.

5. Calendar spread. short Aug 19 107 put and long Oct 21 107 put.

- Aug 9: See above Aug 9 update.

No comments:

Post a Comment