“Eighths/ATR is better than trailing stop.”

Summary of Daily Steps

1.Analyze the Index to determine the right mix of Longs

vs. Shorts. Close the oldest positions first.

2.Scan for high potential entry points using your favorite

technical analysis software.

3.Confirm each entry with the 7 Chart Patterns.

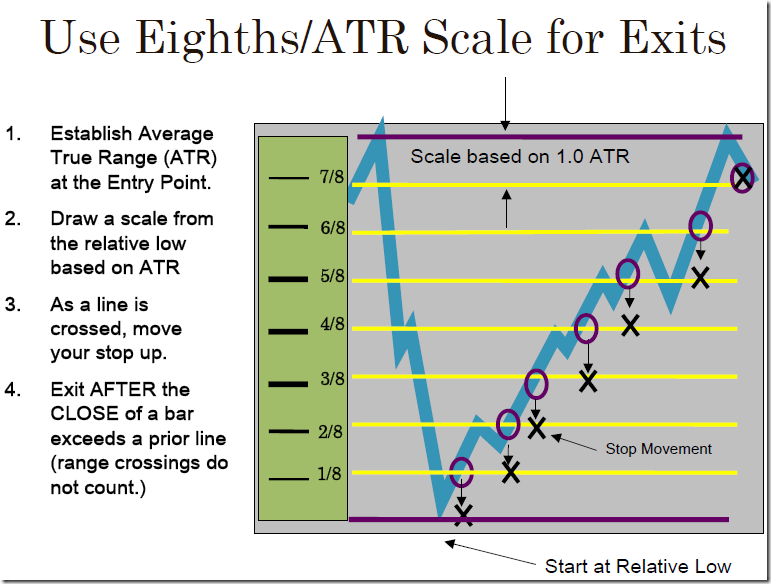

4.Establish stops using the Eighths / ATR scale. If a line

pattern is used (trend line, consolidation, or support),

enter above (below) the break line.

With practice, this process can take just 30 Minutes a day.

No comments:

Post a Comment