Be a good listener to market’s story. As the market moves, it “tells” a story.

21-day, 3% rule when learning new knowledge.

Use indicator (not emotion) to determine entry/exit points. Too many indicators can create confusion.

Candle stick pattern, ideal vs realistic.

SMALL a, b, c, d’s FORM INSIDE C, D’s

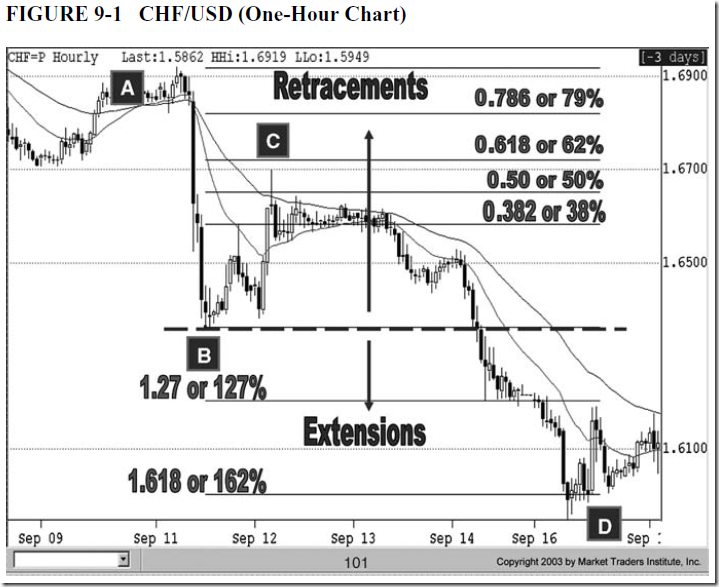

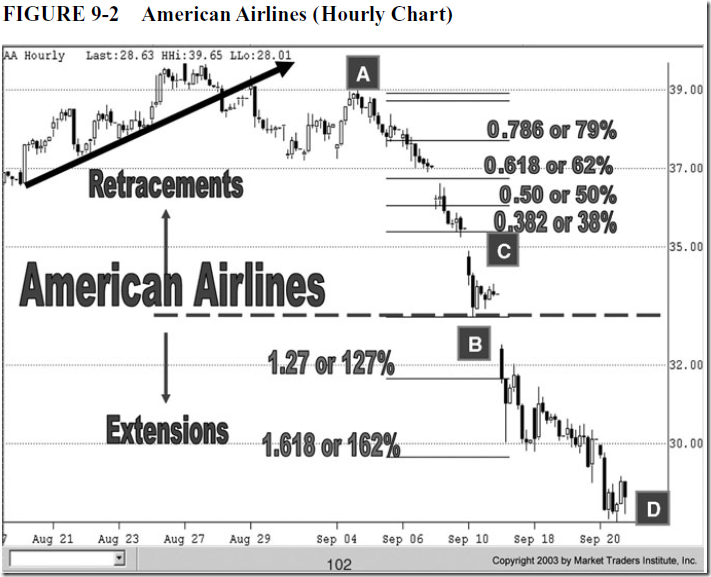

Now that we know that the market moves at different speeds, we need to look

a little deeper into that movement. If the distance between a C and a potential

D is substantial, and there are no fundamental announcements, the market

often forms small a, b, c, d’s between the C, D. This is important to recognize

because most traders are very impatient and want instant gratification. If a

trader has entered the market long or buying, every time the market begins to

retrace or dip, the trader starts to panic and is tempted to exit.

A good habit to get into is to envision the market movement before you

execute the trade. Draw out how you envision the future wave will be. Try

to figure out the amount of time you will need to be in that trade. Then

decide to be a scalper, a day trader, or a long-term trader before you enter

the market. This will keep you from getting frustrated and emotional as you

trade. You must never forget the ebb and flow of the markets and that these

markets wave. It is a natural wave. Very seldom will they race to your

target, regardless of how much you want them to or how little time you have

set aside for trading. The market moves at its own pace, not ours.

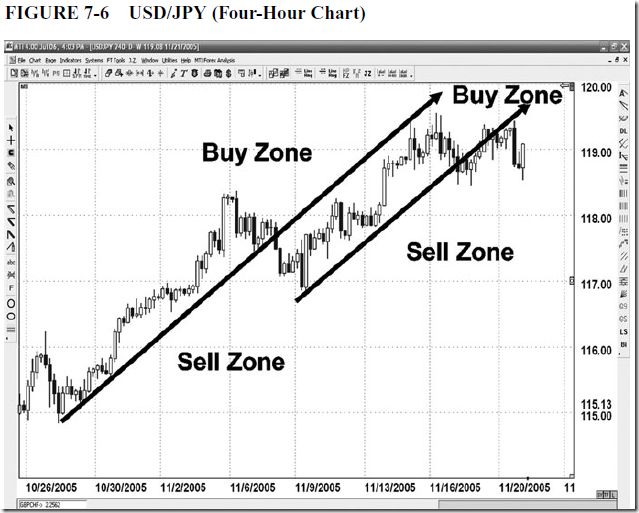

STEPS TO BE FOLLOWED WHEN TRADING AN UPTREND

1. Draw all uptrend lines and downtrend lines, inner, outer, and

long-term. (This will help to determine if the market is in an

uptrend, downtrend, or if a trend line has been broken, signifying

the potential end of a trend or a reversal.)

2. Find the latest upward A, B and use the Fibonacci tool on your

trading software to draw the Fibonacci retracement and extension

lines.

3. Find a C buy-entry at a convergence, such as a Fibonacci

retracement level, upward trend line, morning star, tweezer bottom,

or bullish engulfing candle.

4. Find the projected Fibonacci D extension, as well as four levels of

past resistance. Find the closest level of resistance to the Fibonacci

extension. Place a limit exit order 10 pips in front of, or before it

hits, either the Fibonacci extension or the level of resistance

(remember when the bulls score a point it always pulls back).

5. Look at your potential financial risk with your protective stop-loss

order. If you can’t afford the potential loss should the trade not work

out, then stay out and do not trade!

6. Pull out your trader’s checklist that you have created or the one

supplied by Market Traders Institute. Create a trading plan and

trade your plan.

Trap or fake breakout

straddle

This strategy will work provided your broker will allow you to trade this

way (currently at www. I-TradeFX. com, a Forex Broker, you can straddle

the market in this fashion). Please check with your broker first before

attempting to trade using this strategy. Because of the increased volume of

people wanting to trade the fundamentals, not all brokers can handle the

increased trading volume during announcements.

This strategy is called a straddle and was designed for trading in tight

trading ranges in anticipation of a fundamental announcement. It is very

important that there is a fundamental announcement to be released and that

the market range is between 20 and 60 pips. In order to trade a straddle

effectively, the market needs to create a tight level of consolidation before

the announcement, which, in turn, will provide a straddle opportunity. As a

rule, the longer the market has been in the range, the more aggressive the

outbreak will be (see Figure 11-6).

When you see consolidation forming before a fundamental announcement,

turn to a smaller time frame, such as a 30-minute chart. Place your

straddle orders five minutes before the announcement is made. Place a buy

order 15 pips above or north of the resistance level and 10 pips below or

south of the level of support, or the trading range. Why 15 pips above

and 10 pips below? All currencies have a bid-ask spread that is between

3 and 5 pips. Place your stop-loss orders 15 pips above the last high for the

sell order and 10 pips below the last low for the buy order. The reason your

buy entry order is 15 pips above the last high is because traders look at

bid charts, which reflect the selling price at a particular moment. Because

there is a spread between the bid and the ask price, we need to add the extra

5 pips to compensate for the difference. This precaution will keep you from

being taken into the market too early.

You should also consider not trading if the trading range of the consolidation

is greater than the amount of money you are willing to lose should

the trade not work out. Always remember that the market can break out in

either direction.

It is important that you create two trading plans with entry points, stoploss

orders, and limit orders for profit in both directions. It is also important

to mentally work through a “what if ” scenario. You need to remember

the market can go north or south. If the market goes south, look for past

levels of support to exit with a profit before the bears score any points and

begin pulling back. The opposite will take place if the buy order is triggered

first—look for past levels of resistance to exit with a profit before the bulls

score any points by taking out those highs or past levels of resistance. Bulls

also pull back after making a new high and scoring a point.

No comments:

Post a Comment