The 65sma-3cc Trend-Following System

Sixty-five days is simply the daily equivalent of a 13-week SMA (13x5= 65), representing one-quarter of the year. This is an intermediate length moving average that will consistently follow a market's major trend. the 65sma-3cc system will require three consecutive closes (3cc) above or below the 65-day SMA (65sma) to determine that the trend has changed. For example, the trend will be said to have turned up after three consecutive closes above the 65-day SMA.

SMA65 as trailing stop, C>sma65 and HH20>sma65, ADX18>20, stop: 3xATR40

Channel Breakout-Pull Back Pattern, CB-PB

The channel breakout-pull back pattern is for long trades only. The assumptions underlying this system are:

1. The market will begin an uptrend after the consolidation ends, because it has recently made a new 20-day high.

2. The entry during the consolidation is a low-risk entry point.

3. Exits could be placed at the nearby 20-day high, by using trailing stops, or by exiting after .r-days in the trade.

Input: Xdays (14);

If Highest Bar(High,20)[1] < 7 and Low < Lowest

(Low,5)[l] then buy tomorrow on the open:

If BarsSinceEntry - Xdays then exitlong at the close:

An ADX Burst Trend-Seeking System

During a strong trend, as markets make big daily moves in the di-rection of the trend, the daily ADX momentum can "pop" over 1.0 point, an ADX "burst."

A Trend-Anti-trend Trading System, T-AT

If high > highest (H.25)[1] and ADX(18) < average

(ADX(18).18) then sell tomorrow on the open.

If low < lowest (L,25)[1] and ADX(18) < average

(ADX(18).18) then buy tomorrow on the open.

The anti-trend entry at a new 25-day high is written as follows: if today's high was the highest high of the previous 25 days, but the 18-day ADX was below its 18-day SMA, then sell to-morrow at the market on the open. The countertrend buy signal is also similar.

This approach gives a symmetric long and short sell order on an anti-trend basis. Let us assume you have a long position near a potential bottom. However, the market bounces up for a few days, and then reverses to begin a strong downtrend. In this situation, you want the system to switch to a short trend-following position only if it is long to begin with. Similarly, a new 25-day high with rising momentum is your signal to switch to a long position if you were short to begin with. Thus, the trend-following entries are similar to the anti-trend entries, but you should first test if the system is short or long.

If MARKETPOSITION(O) - 1 and low < 1owest(L,25)[1] and

ADX(18) > average(ADX(18),18) then sell tomorrow on the open.

If MARKETPOSITION(O) - -1 and high > h1ghest(H.25)[l]

and ADX(18) > average(ADX(18),18) then buy tomorrow on the open.

Identifying Extraordinary Opportunities

Some times a short-lived long signal can be a prelude to a strong down move, as the S&P-500 did in 1987

The next major challenge is an exit strategy. A simple strategy of exiting on the close of the twentieth day in the trade works well. An-other exit strategy is to close out the trade when the 7-day SMA moves back inside the trading bands.

Fine tune: ATR-band, SMA50 +/- ATR50, stop: 2xATR50, exit: sma25

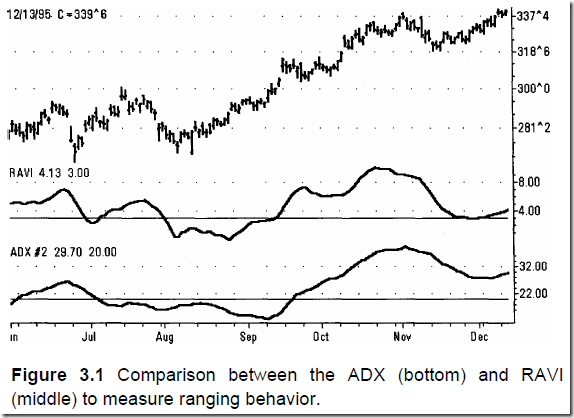

RAVI = Absolute value (100 x (7-SMA-65-SMA)/65-SMA)

Channel Breakout on Close with Volatility Exit

Sometimes there is a big move against the established trend when a

consolidation is at hand. A volatility criterion can pick off the "big"

move against the trend. We want a trailing exit for which we do not

have to specify the .r-day look back period. In effect, we will create a

volatility-based trailing stop.

For example,

near the end of a swing move, the market will often have a wide range

day in the direction opposite the trend. The volatility exit closes a

trade when there is a large daily move against the trend.

A "large daily move" is defined as three times the volatility, and

is called the big move. The big move is added to the most recent 20-

day low for short trades, or subtracted from the most recent 20-day

high for long trades. This yields a specific price for setting an exit

stop.

Volatility is defined here as the 10-day SMA of the daily trading

range. The daily trading range is simply the difference between today's high

and low. Thus, the upper inside barrier is the highest 20-day high minus the

volatility. Similarly, the lower inside barrier is the lowest 20-day low plus

the volatility. We will go long on the close if it is above the upper inside

barrier, and sell on the close if the market closes below the lower inside

barrier. The volatility exit is at three times the 10-day SMA of the daily

trading range.

Two ADX Variations

The second variation does not rely on the absolute value of the ADX;

it requires only that the ADX be rising. The ADX was assumed to be rising

if it was higher than its value 28 days ago. Otherwise, the rules of the two

variations are identical.

These results show that the trend of the ADX is more useful than

the absolute value of the ADX.

The Pullback System

A pullback is simply a minor correction within an uptrend. The

pullback itself could take many forms. For example, you can define

pull-back as three consecutive down days. Perhaps you can define

pullback as a "return to support" by a moving average. You can pick a

variety of averages, such as a 20-day or 50-day simple or exponential

moving average. The term "return to support" is vague—you must

decide if prices must touch the average, go below the average, or get

within 1 percent of the average. Once you agree what "pullback" and

"support" mean, you must then decide at what point to place your buy

order. For example, you could buy at the next day's open, the next

day's high, or at the 5-day high. Picking a precise definition will allow

you to build many variations of this system.

We want to build a system that recognizes a retracement in both

downtrends and uptrends. We will define a pullback as a new 5-day

low in an uptrend or a new 5-day high in a downtrend.

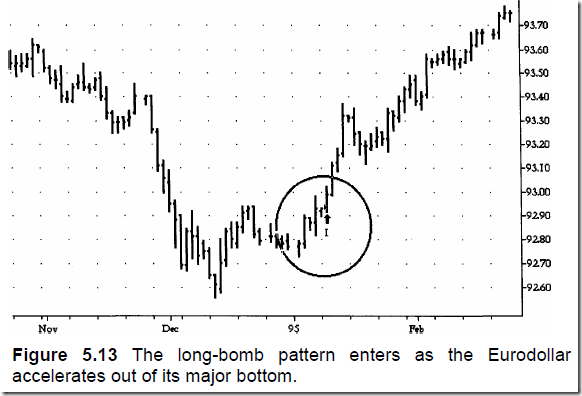

The Long Bomb — A Pattern-based System

1. Today's close is greater than the high of 2 days ago

2. Yesterday's close is greater than the high of 3 days ago

3. The close 2 days ago is greater than the high of 4 days ago

The Risk of Ruin

The mathematical calculations of the risk of ruin are the heart of your

money-management rules. These statistical calculations assume that you

play the game thousands of times with precisely the same odds. However,

your trading situation does not fit this ideal in the real world. Nevertheless,

you can best understand the hazards of leverage by studying the risk of ruin.

Using certain simplifying assumptions, the risk of ruin estimates the

probability of losing all your equity. The goal of money management

is to reduce your risk of ruin to, say, less than 1 percent. Here we

follow the general approach used by Nauzer Balsara (see bibliography

for reference; refer to this excellent book for more details).

There are three variables that influence the risk of ruin: (1) the

probability of winning, (2) the payoff ratio (ratio of average winning to

average losing trade), and (3) the fraction of capital exposed to trading.

Your trading system design governs the first two quantities; your

money-management guidelines control the third. The risk of ruin

decreases as the payoff ratio increases or the probability of winning

increases. It is obvious that the larger the fraction of capital risked on

each trade, the higher the risk of ruin. (Printed entire section. See binder for details.)

You can use the "rule of two," as follows, to modulate your

emotional expectations:

1. Expect half as many winning trades in a row as you project

from your testing.

2. Expect twice as many losing trades in a row as your testing

may show.

3. Prepare for half the expected profits.

Changing Bet Size after Winning or Losing

Jack D. Schwager's interviews with market wizards shows

that many indicated that they reduced the size of their trades during

losing periods.

VIDYA indicator, tbd

No comments:

Post a Comment