In drawing trendlines on candlestick charts, we also have the option of drawing them

from the highs and lows of the wicks or from the highs and lows of the bodies.

More often than not a trading range proves to be a price pause before

resumption in the same direction in which the market was

moving before entering the range. This occurs because markets

tend to trend more than they reverse.

We do this by waiting

for an individual candle to close and then updating our trendlines

if necessary before committing to a direction or trade

We always trade from the perspective that we do not know

whether the level will hold. We do not try to guess whether

the level will hold; we stay patient and let the market tell us if

it is respecting the potential support or resistance. Remember

to “lose your opinion, not your money.” Once the candle is

closed, we get a true snapshot of its behavior.

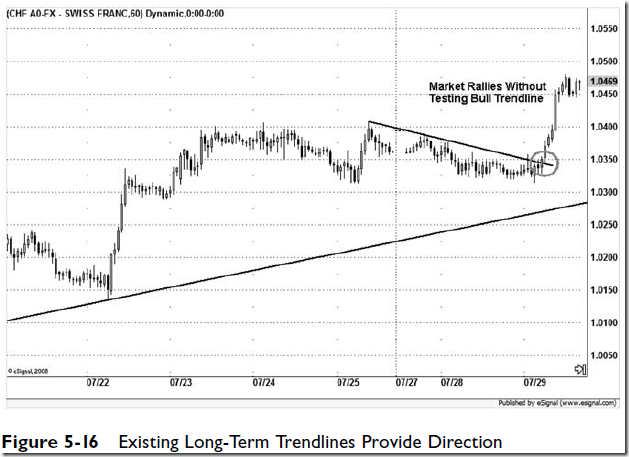

Trendlines are very useful for pointing out direction. Price

doesn’t have to go up to the trendline and give us a textbook

trigger every time. In many cases just having the trendline in

place on the chart will provide a reminder of a market’s current

direction.

In a flat or sideways

environment the market will tend to wrap around its

central pivot, using pivot support 1 (S1) for support and pivot

resistance 1 (R1) for resistance. In an uptrend price often

tends to respect the central pivot or S1 as support and R2 as

resistance, whereas in a downtrend price tends to respect the

central pivot or R1 as resistance and S2 as support.

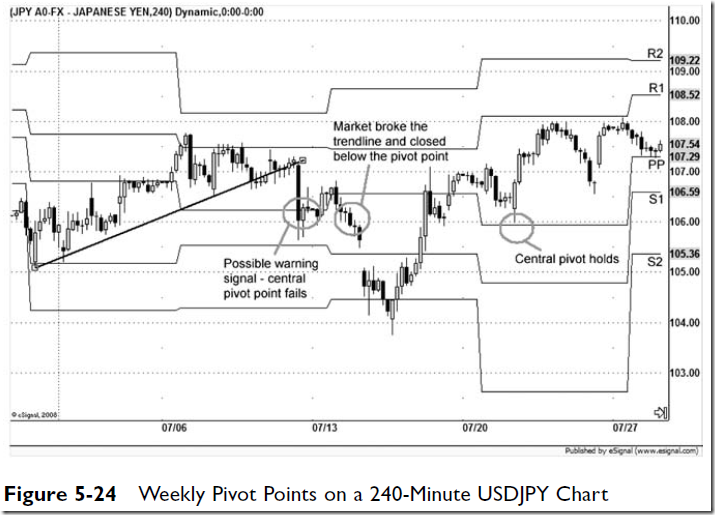

The chart in Figure 5-24 gives us

a hint that a correction may be coming. On this 240-minute

USDJPY chart we see that the market failed to clear R1 three

times and then fell quickly and sliced through its weekly

central pivot on July 11, which was a clear warning sign. It

struggled to get back above that central pivot the next week,

giving traders a chance to exit longs or initiate shorts, before

falling sharply again. After falling too far too fast without even

pausing at S1, the market made a complete recovery ahead of

the weekend. The next week it started to sell off again early in

the week of July 20, only to retest that weekly central pivot,

which held, before moving ahead to post a higher high.

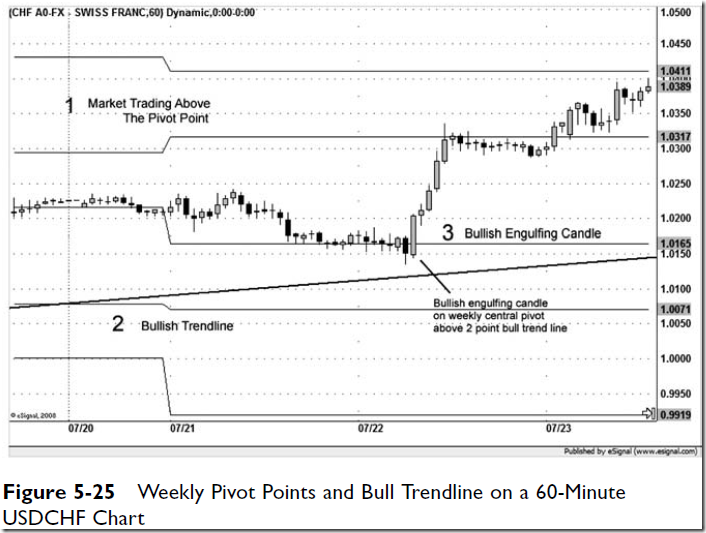

Figure 5-25 shows an example of a buy signal in the form of

a bullish engulfing candle, right on the weekly central pivot of

this 60-minute USDCHF chart. Not only does the market trading

above the weekly pivot tell us that the market is exhibiting

underlying strength, the bullish trendline tells us that the market’s

current direction is higher. The candle clears the high of

the last dozen or more candles, providing a further indication

that the buy signal could be a generous one.

Figure 5-26 shows a session in which the market opens

above the daily central pivot. We also can see on the far left that

on the previous day the British pound challenged R2, which

indicates a strong market. For the session on May 21 we see the

market trade down to test the central pivot and then give us a

bit of a bounce to tell us it respects the pivot, followed by a

retest with an actual close below it, before a change-of-direction

candle and a close above the central pivot, followed by a

nice rally.

A question you may be asking yourself is, “How do I know

which pivot point to place importance on: the monthly, weekly,

or daily pivot?” The answer is that the time frame you are trading

is the pivot point you are going to be watching. If you are

position trading by using the daily chart for entry and exits,

you are concerned with only the monthly pivots. For trading

between a 60-minute and a 240-minute time frame, you follow

the weekly pivots, and for day trading, you use the daily

pivots. If you are in a trade on a lower time frame and the market

outruns the appropriate pivot points, you can consult the

next higher time frame’s pivots.

pivots are a trend-following tool in that they expand and contract on the

basis of previous market behavior.

Figure 5-33 shows the same day we just examined, but on

the next lower time frame. Here we again see a change-ofdirection

candle, this time on the 60-minute chart. Of course

we don’t know at the time that this intersection of a trendline

and a 0.618 percent retracement will hold, but when we see the

change-of-direction candle put in the double bottom here, just

below 104, we don’t think, we buy.

Although Fibonacci retracements are more of a countertrend

tool in that they measure primarily corrective price behavior,

Fibonacci extensions are a trending tool because they are

Figure 5-36 shows a late summer rally in 2007 in GBPUSD

and then a sharp correction lower by approximately 66 percent

of the up move into mid-September, which provides a retracement

from which to draw an extension higher. In this case the

market pulls up short of the 100 percent extension in early

October and proceeds to move sideways for much of the

month before slipping higher toward the end of the month. The

second close above the 100 percent extension proves to be a

“breakout” above both that level and the isolated high back in

July, and we get a very fast rally, or a climax rally, up to the

1.618 extension level.

there are plenty of

levels for traders to be concerned about on a chart, but the

most important thing to remember is that we don’t respect the

level unless the market does that first.

Technical analysis is, after all, an art and

is based on the assumption that “the charts tell us everything

the market knows about itself.”

In markets we often see an

orderly price move to establish direction, then acceleration

on increasing volume, followed by a dramatic sell-off.

These formations are characteristically larger than flags and

take more time to develop. As in any breakout, we must wait

for the candle to close outside the formation.

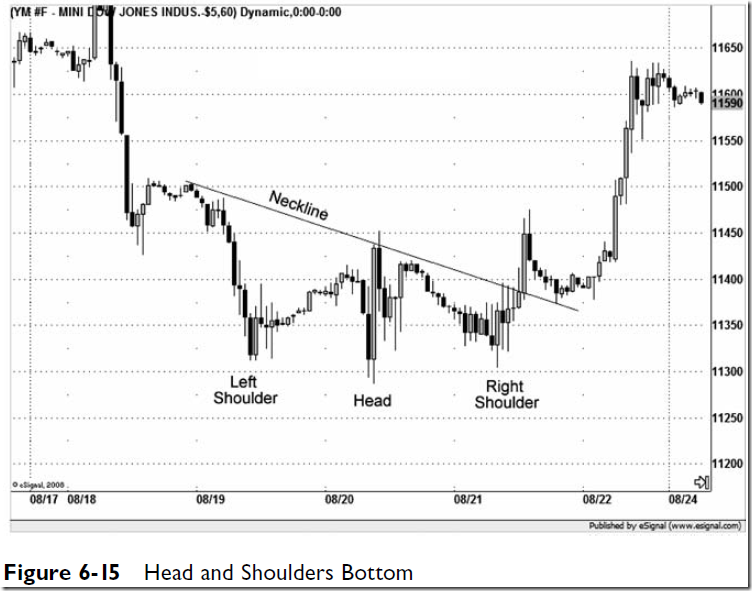

We are going to cover reversal patterns next, and it’s important

to remember that these topping or bottoming patterns are

not nearly as common as continuation patterns. A word of caution

is due in addressing reversal patterns, particularly on long term

charts, because they occur less often. There is something in

human nature that makes us feel we need to change things for

the better. Beginning students imagine that they can discern a

change in the market before the rest of us and call a market top

or bottom and maximize their profits along the way. Experienced

traders know better and are more interested in going

along with the market, which means trading through more continuation

patterns than reversal patterns. It is best to understand

this human tendency to change things at the very beginning of

a trading career. The only thing we need to change as traders is

our perceptions of our significance in the face of the market.

A rising wedge is a bearish formation that usually is seen as a

reversal pattern but also can be a continuation pattern. Here we

will focus on reversal patterns. A rising wedge can be seen on

the charts as an up move with a wide shape that gradually

narrows as it rises, giving it a cone shape. It can be tricky to

identify as being bearish because it exhibits the higher lows and

higher highs that are the hallmark of an uptrend. What helps

us identify it as a reversal formation is the decreasing volume

on each successive rally.

Despite what most analysts believe, technical indicators were not designed to predict future price movement as much as to define current price movement. It is believed by most experienced money managers and traders that the simplest formulas often lead to the most successful trading.

Most leading indicators measure

momentum, or the degree of the slope of a current price movement—

i.e., the speed of the trend—and are called momentum

oscillators.

It is thought

by many experienced traders that the most important skill a

trader can have and the one that is the hardest to achieve is the

ability to “let a profit run,” or stay in a position longer and maximize

profits. Two of the main reasons for this are emotions,

generally nervousness, and leading indicators. Trend traders

need to be comfortable with lagging indicators.

In Figure 7-3 we have an 89-period and a 144-period EMA

cross that generates a sell signal on the daily chart. 6 month drawdown

although the zero line cross by the black line is still the most

influential signal because it is a trending signal, we also have

the MACD-trigger line cross, which can be both a trend signal

and a countertrend signal.

MACD Histogram

The rate of change between the two lines (the MACD and the

trigger line) also provides an indication of the strength of a

move.

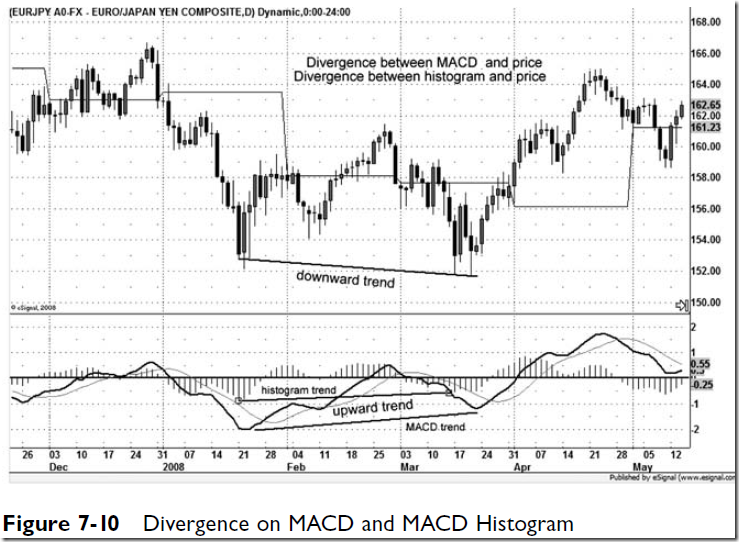

Traders often ask, “Which divergence should we look for,

that between the MACD cross (the black and gray lines) and

price or that between the MACD histogram and price?” The

answer is either one; however, short-term divergence generally

will show up first on the histogram and can be more significant.

By coupling a shorter time frame EMA that has

smaller deviations with an 18-SMA that has a 2 standard

deviation Bollinger band, we may be tipped off sooner

that a desirable setup is in the making.

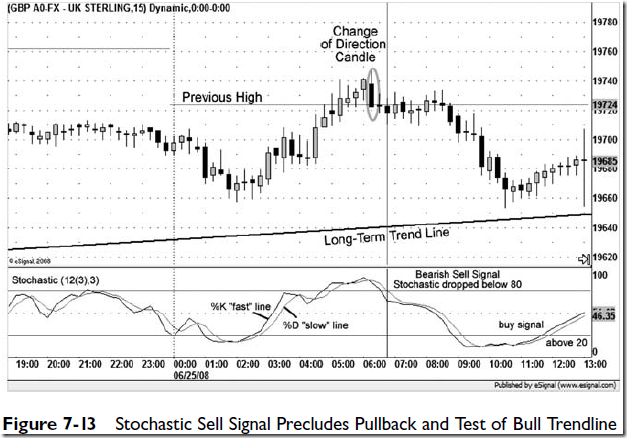

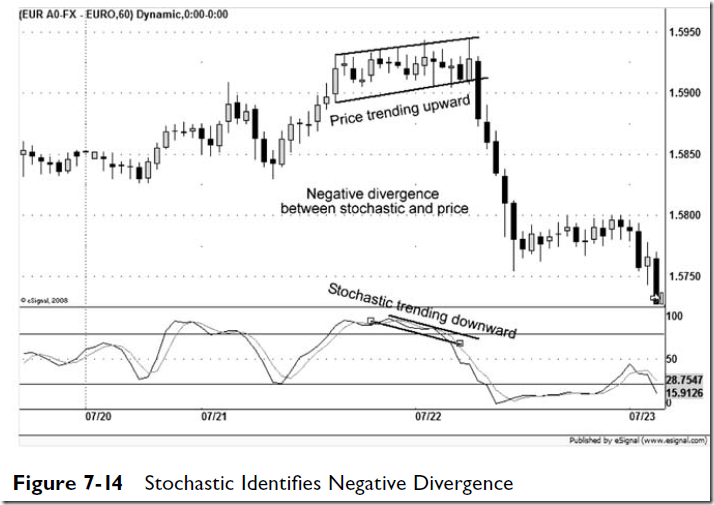

Because

a stochastic is so sensitive, it is a good indicator to use for signal

generation that gets you in quickly.

Some traders also use a stochastic in their short-term trading

by taking a close above 70 as a buy signal and a close below

30 as a sell signal. This may seem counterintuitive initially but

can work well in identifying markets that are accelerating.

Another way to use the signal is to wait for a second cross

down from the upper level or a second cross up through the

lower level before entering a position. The stochastic is a sensitive

indicator, and by seeking out markets in which it gives

that second cross for a signal, it is thought that a trader can

help increase the odds of success on a trade.

It is rare to see an RSI reading above 80 or

below 20, but when those numbers come, they are significant.

A reading below 20 generally indicates that a lower low in

price is still to come, and a reading above 80 almost always

means that a higher high in price is to follow.

Just

as we can draw trendlines that act as support and resistance

on the price chart, we can draw trendlines on an RSI chart that

may act as support and resistance.

the

majority of CCI values would fall between 100 and -100. When

the market moves above 100, it is thought to be entering

an uptrend and a buy signal is given, and when the market

moves below the -100 CCI reading, a sell signal is generated.

Similarly, a move up through -100 would be seen as a countertrend

buy signal, whereas a move down though 100 would

be seen as a countertrend sell signal. By not considering price

action between the 100 and -100 levels, the trader avoids much

of the sideways or countertrend price action and seeks out

the times when markets enter into cyclical moves.

Assuming that a quarterly cycle is a good fit

for a currency, we went with a 20 length CCI in this example.

Figure 7-17 shows how a CCI trendline

signal followed by a move above 100 provided timely buy

signals in USDJPY.

The reading on this chart for February 1 is

0.0237, which tells us that the ATR over the previous 14 sessions

was 237 pips. Therefore, we can surmise that if we take

a position in this market and want to place our stop far

enough away from price to avoid being stopped out on a random

intraday price spike, this information will be helpful. We

may decide that a 2 ATR stop would be appropriate—placing

our stop over 474 pips away from our entry—in that it would

give us enough room to stay in the trade and not have to

worry too much about price stopping us out prematurely.

That will help us determine how

much we would need to expect to risk or if we could even

afford to take a position in that market.

No comments:

Post a Comment