in our trading careers we will see more of these than reversal

patterns. It is the nature of markets to trend more than they

reverse.

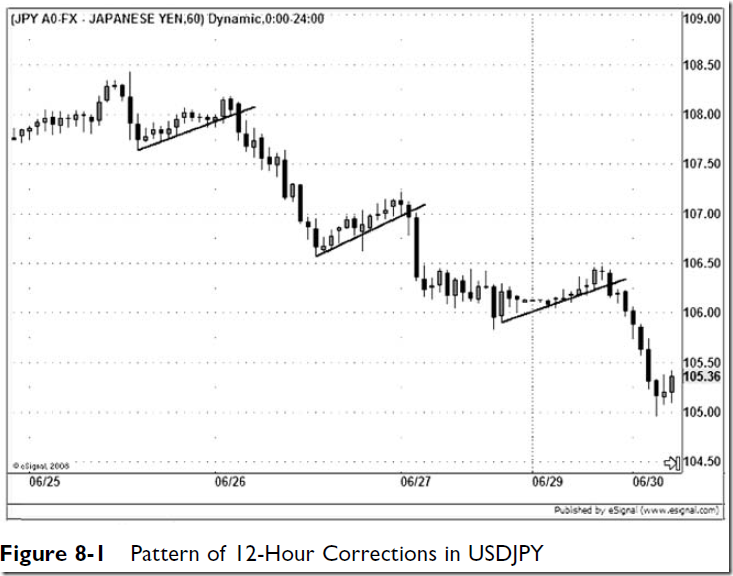

As quickly as markets show repetitive behavior, the pattern

fades away and shows up at a later date with a slightly different

cadence and a longer or shorter distance.

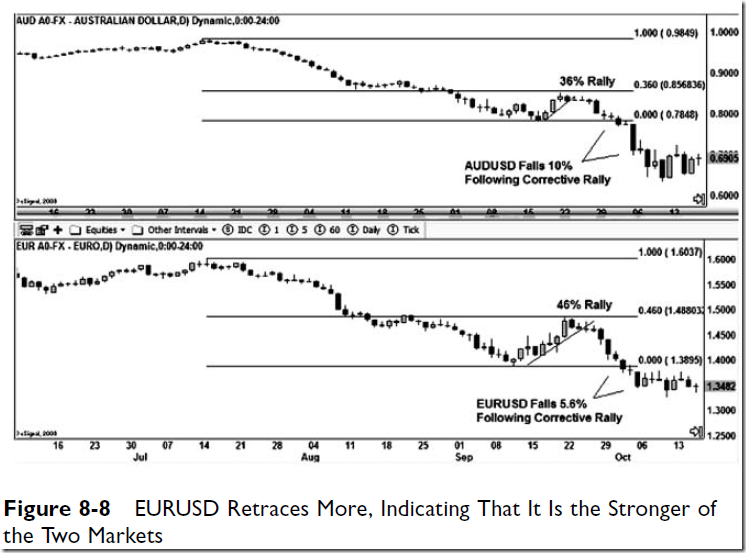

This chart provides a great example of why professional

traders always buy strength and sell weakness. The price corrections

in September gave market participants a clear look at

which markets were weaker than the others, and traders voted

with their money, giving us a very impressive rally in

EURAUD in early October.

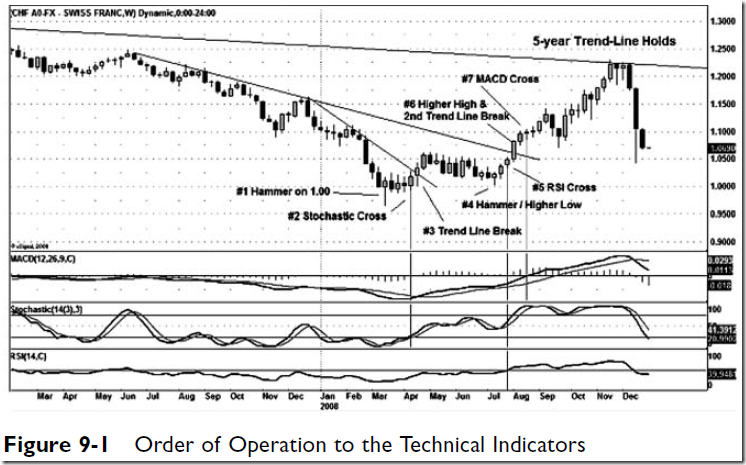

One of the most reliable trade signals is the combination trendline

break and stochastic cross.

When we use the trendline and stochastic cross signal, we

don’t need the MACD histogram for confirmation, but we want

it to confirm within the next couple of candles. Arule of thumb

is that if we are considering a trade signal and the MACD histogram

is moving opposite to the signal, we know we are very

likely to be entering a countertrend trade and should be even

more active in monitoring the trade. Preferably, we want at least

the MACD histogram starting to stair-step in favor of the trade.

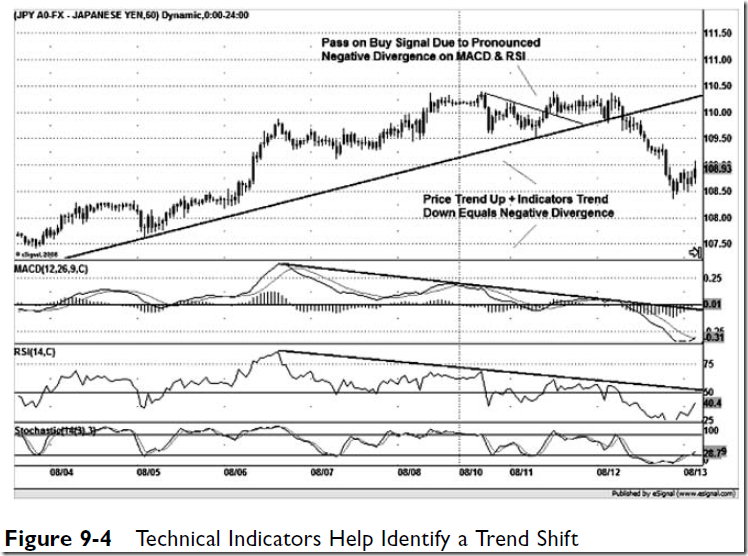

When a price

move is marked by a nearly parabolic candle like this one, it is

best to stick with signals in the same direction as the momentum

or just not trade. The MACD confirms our decision not to

take the signal as it is below both the zero line and the trigger

line.

the difference between trending

and countertrending markets by pointing out that elongated

candles extending up or down identify trending, or impulsive

price action, whereas shorter candles with smaller bodies

indicate countertrending price action, or reactive trading. This

is an important distinction for a trader because although our

indicators and overlays remain the same, our trading strategy

will differ slightly with the type of market we are in.

Trending markets call for making quick decisions upon entering

a trade but showing more patience once one is in the market,

whereas countertrending markets give the trader more

time in taking a trade but require less time in the trade and

speed in exiting.

A very important difference between a trending market

and a countertrending market is that in a trending market

the higher time frames will dictate price movement and

direction, whereas in a countertrending environment the

lower time frame charts can dictate direction. This means

that in a trending market you do not want to go against the

trend on the next higher time frame. In a countertrending

market you are taking signals on the lower time frames

routinely regardless of the previous direction on the higher

time frames.

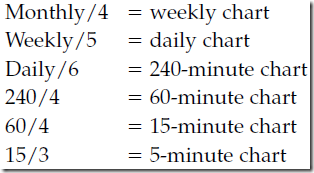

In analyzing a market we never skip over a time frame. If we

are trading off a 60-minute chart, we look to our 240-minute chart

for confirmation. We never jump time frames because we would

lose continuity. If we see a signal on the daily chart, we look to

the trend on the weekly chart for confirmation. If we see a signal

or setup on the 15-minute chart, we look to the 60-minute chart

for confirmation. It is paramount to maintain this continuity.

We should

always take direction and identify a trade setup from our

intermediate-term chart, in this case the weekly chart. We can

look to the long-term chart for confirmation or support—though

this is not a prerequisite, particularly if one is day trading—and

use the short-term chart to hasten our entry and exit signals.

Waiting for the weekly chart to confirm does not necessarily

mean waiting till the end of the week. If the behavior

of price on the weekly chart gives us a sell indication on a daily

close, we can take this as higher time frame confirmation.

If we have a favorable

setup on the intermediate-term chart, we can wait to take

a signal on that chart or look to the short-term chart for a signal

in the same direction. If we take a signal on the short-term

chart and the intermediate-term chart doesn’t confirm within

three candles, we need to exit the trade quickly.

For

trading, we define the three time frames as the short-term

trend, which can be as short as two candles if price has closed

beyond the last trendline and as long as 15 candles; the secondary

trend, which can be as long as 15 to 60 candles; and

the primary trend, which can be from 60 candles to hundreds.

Figure 9-11 shows how tightly the stochastic follows the

short-term trendline shifts and how the shifts occur as old

trendlines give out, allowing a new trendline to begin. Agood

rule of thumb for active markets is that once the stochastics

cross and close above the oversold line, the short-term trend

has shifted higher, and once they cross and close below the

oversold line, the short-term trend has shifted lower. As

always, we need to confirm the trend by the pattern of highs,

lows, and closes. Another technical rule of thumb is that once

the MACD crosses and closes above or below zero, the intermediate-

term trend is shifting.

It is also important to understand that once a short-term

trendline is violated, it is likely that the market will migrate to

the intermediate-term trendline, and once the intermediateterm

trend is violated, it becomes more likely that the market

will try to test the long-term trendline.

At this point it is tricky

to determine whether we have a new trend in place or simply a

secondary rally just before a climax. As long as we are below the

long-term trendline, we assume the second case: We are seeing

a secondary rally marked by impulsive price behavior that tends

to fade quickly in the face of the more mature primary trend.

Coordinating time frames also means seeing setups on a

higher time frame and then waiting for a signal in the same

direction on the next lower time frame. An important aspect of

this tactic is to remember that once the signal comes on the

lower time frame, it is important to look back to the higher time

frame to make sure the indications that originally warranted the

signal are still in place.

The point here is that it is wise to keep track of

the primary trend and the secondary trend because by nature

a secondary move will start out strong and fast but fade sooner

than inexperienced traders think, just as the primary trend will

start slower yet stay intact longer and move farther than most

market participants think.

Another word of caution about secondary

moves: Because they start out fast and exhibit impulsive

behavior, they generally will overrun support and

resistance levels such as previous highs and lows, pivots, and

retracement levels quickly, leaving untrained traders to believe

that a new trend is under way.

When we see a trade signal on a chart and look to the next

higher time frame for confirmation, it does not mean that the

trend must be in agreement, but it does mean we should be

seeing indications that support the signal in the lower

time frame. An indication on the higher time frame that

is in agreement with the lower time frame could be considered

a countertrend signal by a leading indicator such as a stochastic trigger line cross, divergence on a momentum

indicator, a trendline violation, or even a one-bar reversal on

the MACD histogram.

The downside of using higher time frame charts to confirm

lower time frame charts comes when we are in a sideways or

countertrending market or when we are seeing trends reversing.

If we always use the higher time frame to confirm, we will

miss the reversals, which by definition occur on the lowest time

frames first. This is why it is so important that traders understand

the importance of both trend trading and countertrend

trading.

Another big problem for many beginning and undercapitalized

traders is that they spent too much time trying to figure

out which direction they think the market will move in on

the lower time frames instead of just taking signals and moving

in whichever direction the market moves.

the only goal a trader should have is to have the discipline to follow her trading plan. Always remember that

trading is not about being right or wrong or even about thinking; it is about executing one’s plan.

One of the biggest personality warning signs for traders

comes from people who are accustomed to getting other people

to change their minds or willing people to do things that

aren’t in their best interests. Salespeople come to mind. If you

are used to being able to manipulate people, you will be in

for a surprise when you trade, because you cannot cajole or

bluff the market. It is said that the worst products have the

best marketers, and nowhere is this truer than in the brokerage

industry. Because of this, brokers tend to have very limited

success as traders. Brokers are not alone on that list,

however. Lawyers also often struggle as traders. Many

advanced education professionals, coming from a field in

which linear logic, not intuition, is practiced, have an uphill

struggle too.

Trading-U.com

Though the market trades around the

clock from Sunday 5 p.m. EST through Friday 5 p.m. EST, it is

common parlance to refer to 5 p.m. EST as the close because it

marks the change from one day to the next on the daily chart.

Being a position trader often means

going through periods in which you have more losers than

winners; this highlights how important it is to get those longrunning

winners. When you do get a winner and learn to let

the trades run, you will find that on average your winners are

much larger than your losers; this accounts for the favorable

risk-reward ratio that position traders enjoy compared with

traders who work the lower time frames.

In a position

trade—or any trade—you should be risking only a small

percentage of your overall risk capital. For professionals this

may be as little as 0.5 to 1 percent. For beginners, who are

often undercapitalized by definition, it should never be over

5 percent and preferably should be closer to 2 percent.

The disadvantage of position

trading is the other side of the risk-reward coin: Your losses

will tend to be larger than they would be if you were trading

a smaller time frame. We recommend always starting out with

just one contract per position trade and keeping your stop far

enough away from price so that you will not be knocked out

prematurely by the larger intraday price swings in markets that

are due to fundamental news releases and other day-to-day

happenings in the world and in financial markets. Your stop

generally should be placed just beyond the last swing high or

low on the chart.

Swing trading involves shorter time frames than the daily

charts; this generally means trading from the 240-, 60-, and

15-minute charts.

The trader determined that he would take buy signals

generated by trendline penetrations and zero line crosses on

the MACD on a closing basis on the 60-minute chart if that

occurred above the weekly pivot point and the MACD was

above the zero line on a closing basis on the 240-minute chart.

Once the trade was initiated, a stop-loss was entered at a price

equal to 2 percent of his account balance or just below the low

of the previous candle he entered on, depending on which

number gave the trade more room.

a combination of a trendline break and an

MACD cross of its trigger line on the 60-minute chart to exit.

Day trading is very much a microcosm of position

trading and swing trading. The only difference is that in day

trading one must be aware of scheduled economic releases and

other world or financial market developments that can affect

price movement over the short term or intermediate term.

In day trading, you always should exit your position 5 to 10

minutes ahead of major scheduled economic releases. We use

www.forexfactory.com for its calendar and anything marked in

red or orange to be a major release. After an important news

release we do not enter trades until the candles on the charts with

the shortest time frame stop showing dojis and start showing

wider candle bodies. Remember that dojis show indecision and

the wider bodies show that trade is being facilitated.

For day trading we recommend using the 15-minute chart

for timing and patterns, the 60-minute chart for direction and

confirmation, and 5-minute or 3-minute charts to help time

entries and exits.

Before the news release in Figure 11-3 we had a sell signal

on the 60-minute chart hours earlier, and on the 15-minute

chart we see that the MACD had dropped below the zero

line and stayed below zero despite the short-lived rally that

followed the 7:30 a.m. CST release. We know that this is bearish

behavior, and it also tells us that the trend on the next lower

time frames is going to be lower also. After slumping lower,

the market tried to rally one more time and ended up forming

a small symmetrical triangle on the 15-minute chart. Symmetrical

triangles, as we know from Chapter 6, tend to be continuation

patterns that are likely to break out in the same direction

in which they were moving when they formed their base. In

this case, the base was created while moving north to south, or

higher to lower, and the market was exhibiting a pattern of

lower highs. However, we still would wait for a close outside

the triangle before initiating a trade.

On our 15-minute

chart we also have a 5-simple moving average set to the close

that we would use to keep us in the trade. As long as candles

closed below the 5-SMA line, which is marked in black, we

would continue to hold our short position.

Always Have the Appropriate Phone Numbers on Hand

You also will find that trading can be stressful because as

humans we are programmed from the beginning to improve

our situation and surroundings and have emotions. This

means we have an innate urge toward progress, and when that

drive is slowed or stopped, we become frustrated. Frustration

creates stress. If we feel that our progress has been stopped or

even reversed, as happens when a trader is experiencing

a position going against him or her, that frustration can turn to

anger and fear. We will always have emotions; the difference

between a professional trader and a beginner is that the professional

is prepared for the emotions and the stress they

create. This preparation starts with writing out a trading plan.

Regardless of the emotional desire to close out the position at

a loss and stop the fear or try to fight the market by increasing

the position, professional traders follow their trading plans

automatically because that is how they have programmed

themselves and because they know it is their only defense.

2 examples, see printout in binder.

What you write in your trading journal is up to you. If there

is one thing that should be mandatory, it is that every time you

make a trade, whether a demo or live, you need to write down

the following:

1. Market traded

2. Direction traded from

3. Date and time

4. Signals used

5. Time frame traded

6. Trend or countertrend

Bibliography

Boroden, Carolyn. Fibonacci Trading. New York: McGraw

Hill, 2008.

Dalton, James, Eric Jones, and Robert Dalton. Mind Over

Markets. Chicago: Probus, 1990.

Falloon, William. Charlie D. New York: Wiley, 1997.

Fischer, Robert. Fibonacci Applications and Strategies for

Traders. New York: Wiley, 1993.

Gann, W.D. How to Make Profits Trading in Commodities.

Pomeroy, WA: Lambert–Gann, 1942.

Goodspeed, Bennett. The Tao-Jones Averages. New York:

Penguin Books, 1984.

Kase, Cynthia. Trading with the Odds. New York: McGraw

Hill, 1995.

Kirkpatrick, Charles, and Julie Dahlquist. Technical Analysis.

Upper Saddle River, NJ: FT Press, 2007.

LeFevre, Edwin. Reminiscences of a Stock Operator. New York:

The Sun Dial Press, Inc., 1938.

Lipton, Bruce. The Biology of Believe. Santa Rosa, CA: Elite

Books, 2005.

Mandelbrot, Benoit, and Richard Hudson. The (Mis)Behavior

of Markets. New York: Basic Books, 2004.

Murphy, John. Technical Analysis of the Futures Markets. New

York: New York Institute of Finance, 1986.

Person, John. A Complete Guide to Technical Trading Tactics.

Hoboken, NJ: Wiley, 2004.

Rhea, Robert. The Dow Theory. New York: Barrons, 1932.

Reprint New York: Fraser, 1993.

Sperandeo, Victor. Trader Vic—Methods of a Wall Street Master.

New York: Wiley, 1993.

Williams, Bill, and Justine Gregory-Williams. Trading Chaos.

2nd ed. Hoboken, NJ: Wiley, 2004.

No comments:

Post a Comment